China's transshipments to the US

China is likely circumventing US tariffs by exporting to the US via third countries

In yesterday’s post, I argued that the peg of the Yuan to the Dollar traps China in a deflationary equilibrium. That’s because what’s needed is drastic monetary easing to bring down real interest rates, but this is impossible because an inevitable byproduct of such easing would be a fall of the Yuan against the Dollar, which China’s political leadership is averse to.

One pushback to my argument has been that China can simply use fiscal stimulus to avoid deflation. I don’t think that’s right. US tariffs amount to a shift weaker in the fair value of the Yuan against the Dollar, for which the only remedy is devaluation. Fiscal stimulus can’t fix that and will only result in an open-ended debt run-up. China is still struggling with the aftermath of its massive debt expansion after the global financial crisis and is - understandably - reluctant to do that.

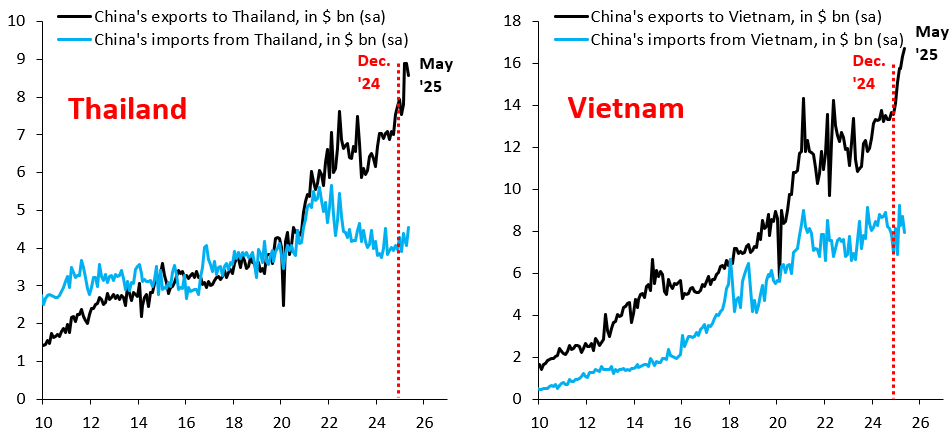

Another pushback is that the tariff shock really isn’t that bad, because the US has been slow to implement tariffs, so - effectively - this shock hasn’t yet fully hit. That argument is also questionable, because China’s exports to places like Thailand and Vietnam are up sharply, which suggests goods are being transshipped to the US via these places. That can only be happening because tariffs are a very material shock.

The two charts above show exports from China to Thailand (lhs) and Vietnam (rhs). They show that China’s exports to both countries have risen sharply so far this year. It’s unlikely that demand for Chinese goods has boomed in both of these places, so it’s more probable that these are transshipments that are ultimately destined for the US. After all, the US is the biggest buyer of consumer goods and China is the biggest producer. These two forces have to meet, if need be in circuitous ways.

The left chart above shows that the EU isn’t immune to this either. China’s exports have risen sharply also here and domestic demand is again an unlikely driver. When I total up China’s trade surplus with 14 of its major trading partners and compare that with its US surplus, the right chart shows that transshipments likely provide a full offset to the reduction in China’s direct surplus with the US. These transshipments help Chinese exporters avoid the 50 percent tariff rate that’s now imposed on them, which is the rationale for sending goods to the US in this roundabout way.

The massive scale of these transshipments is testament to the fact that US tariffs are clearly biting. This means the deflationary impulse is already in train, which makes a rethink in China on its management of the exchange rate all the more urgent. Without such a rethink, China is heading straight for deflation.

The data set forth, contrary to your conclusion, suggests that China is effectively avoiding or minimizing the tariff impact through transshipments. If that is the case, the inflationary impact of tariffs in the US will be less than expected, and the deficit will balloon due to lower than expected tariff revenue.

Trump is allowing transshipments to modulate the introduction of tariffs levels to be less disruptive in the early stages and wait for currency devaluations

China is playing politics to try to hurt trumps poll numbers so Trump is slowing implementation until currency adjustments in China and Europe start