Emerging markets as the US attacks Iran

Emerging markets are more vulnerable than in the past to large-scale capital outflows

The US has attacked Iran’s three main nuclear sites and is threatening more attacks if Tehran doesn’t capitulate. When markets open tonight, barring further developments, several things will happen: (i) oil prices will rise, as markets price higher risk of supply disruptions; (ii) risk aversion will go up, which will benefit safe haven assets like the Dollar, the Swiss Franc and the Yen; and (iii) emerging market (EM) currencies will weaken, as global investors retreat to safe havens.

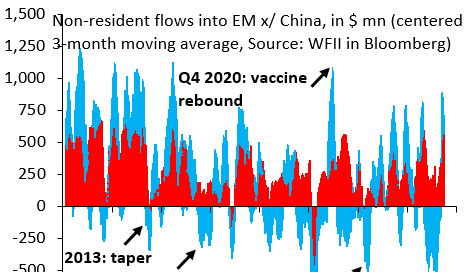

Adverse fallout on EM may be especially severe because capital inflows have been unusually strong in recent weeks. The chart below shows a centered, three-month moving average of foreign inflows into EM debt (red) and equity (blue). Underlying data are from Bloomberg’s WFII screen, which lists daily or weekly capital flows into all major EMs. In balance of payments terminology, these flows correspond to non-resident portfolio flows into EM bonds and stocks. The last observation in the chart is for June 20, which means that the centered, three-month moving average captures the six-week period leading up to that point.

In the run-up to today, capital flows to EM had risen to their highest level since the COVID rebound in the fourth quarter of 2020. The strength of these flows embedded an expectation in markets that the US tariff onslaught is essentially over, with unusual moves in the Treasury market in the week after “Liberation Day” convincing the White House to refrain from any further escalation of the trade war. Markets were therefore running full tilt in the direction of EM as the US yesterday joined Israel’s attacks on Iran. This heightens the risk of a violent reversal in these flows, which could cause EM currencies to weaken sharply.

Of course, EM isn’t a homogeneous group. Oil exporters like Russia and Saudi Arabia will benefit. Producers of other commodities, notably in Latin America, will likely also benefit, as rising oil prices tend to pull up other commodities. Energy importers like Turkey and countries in Central and Eastern Europe will get hit harder. The best advice I have for EMs is to resist the urge to intervene and manage their exchange rates. This will just squander reserves and may make capital outflows worse. Better to just let currencies fall, which will protect growth amid all this volatility.