Global FDI is uncoupling from China

FDI into China is on a declining trend, in contrast to FDI to the rest of EM

A few weeks ago I wrote a post about how foreign investors have been putting less money to work in China, with non-resident flows into China a lot weaker since the invasion of Ukraine. Weaker foreign flows into China stand in contrast to flows to the rest of EM, where inflows have rebounded to very robust levels. This suggests that global markets - in the wake of the Ukraine invasion - are paying closer attention to geopolitical risks and are taking a more cautious approach to China.

This trend in portfolio flows parallels what is going on with foreign direct investment (FDI), which has also been weakening into China, even as it remains robust to the rest of EM. That’s what I highlight in today’s post and this adds to an overall picture where global markets are increasingly uncoupling from China.

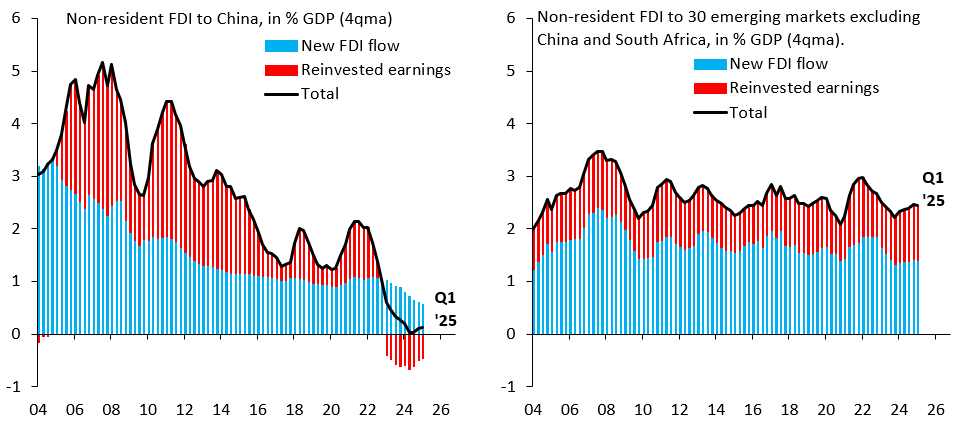

The left chart above shows non-resident FDI into China (black line), breaking this down into genuine new FDI investment (blue bars) and reinvested earnings (red bars), which reflect retained profits of foreign subsidiaries in China. The latter have in the past been strongly positive, as foreign subsidiaries found it difficult to repatriate earnings back to their home countries. More recently, these reinvested earnings have gone negative, a sign that foreign subsidiaries in China may be making losses.

The more interesting development is the sharp fall in genuine new FDI flows into China, a trend that’s picked up in recent years. The right chart shows that this drop-off in genuine new FDI stands in stark contrast to the rest of EM, where new FDI inflows are stable. This adds to the overall picture - factoring in the uncoupling that’s also going on with portfolio flows - where global markets are becoming more cautious about China. This may not just be about heightened geopolitical risk, but could also reflect a saturation of foreign physical presence in China, especially now that trade tensions with the US are mounting once again. Overall, China’s status as an export hub for the world looks increasingly challenged over the medium term.

one of the direct consequences of this trend is the need for China to support is current account surplus…China needs current account surplus to backstop capital (out)flows. The US are a more attractive investment destination and this is why they have been running a trade deficit for the last 48 years

What is the source for the data splitting up FDI flows and reinvested earnings? I’ve seen lots of analyses mentioning this but there is rarely data attached!