How bad is the US debt binge?

Fiscal policy is out of control, but other sectors are deleveraging

One of the more puzzling things about 2025 is that long-term US Treasury yields have fallen despite a fiscal picture that’s out of control and erratic leadership. Markets are debating three possible explanations for this. First, while public debt is rising fast, the rest of the economy is deleveraging, so that overall indebtedness is pretty stable. Some people think this is what’s holding down Treasury yields. Second, increasingly dovish expectations for the Fed are pulling down front-end yields, which also pulls down the long end of the yield curve. That’s consistent with the 10-year yield falling sharply in August and September after the dovish Jackson Hole meeting. Third, even if the US has many problems, the challenges facing other countries are worse. As a result, US Treasuries have been getting safe haven inflows, especially as traditional safe havens like Japan and Germany are falling by the wayside. Today’s post reviews each of these. My money’s on the last explanation. The US is still the best of a bad bunch.

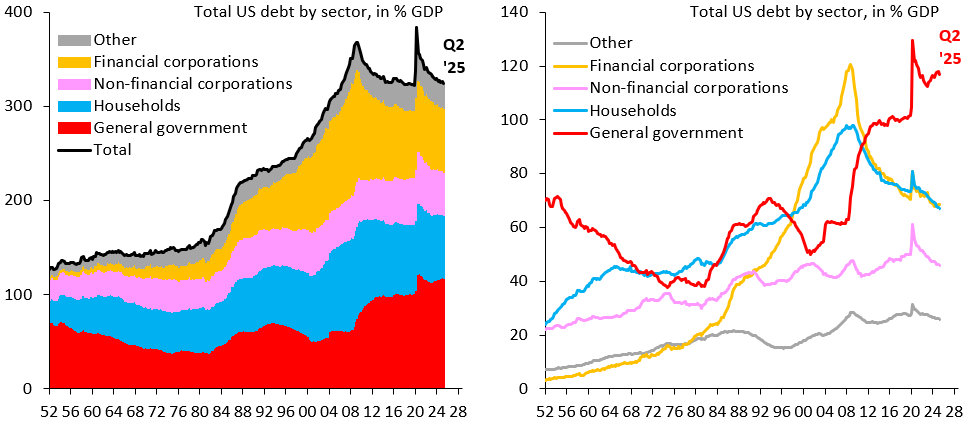

The two charts above show indebtedness across different sectors in the US economy. The left chart stacks all sectors to show the evolution of overall indebtedness over time. The right chart shows all sectors side by side to highlight where indebtedness has gone up or gone down. It’s clear that public debt has risen sharply (red) and that this rise has been offset by falling indebtedness in the household (blue) and financial (orange) sectors. The reason I don’t think private deleveraging is behind this year’s fall in long-term yields is that this is a long-established trend since the 2008 crisis. There’s just no way a long-term trend like this wasn’t priced long ago, so this just isn’t a good explanation for why yields are down in 2025.

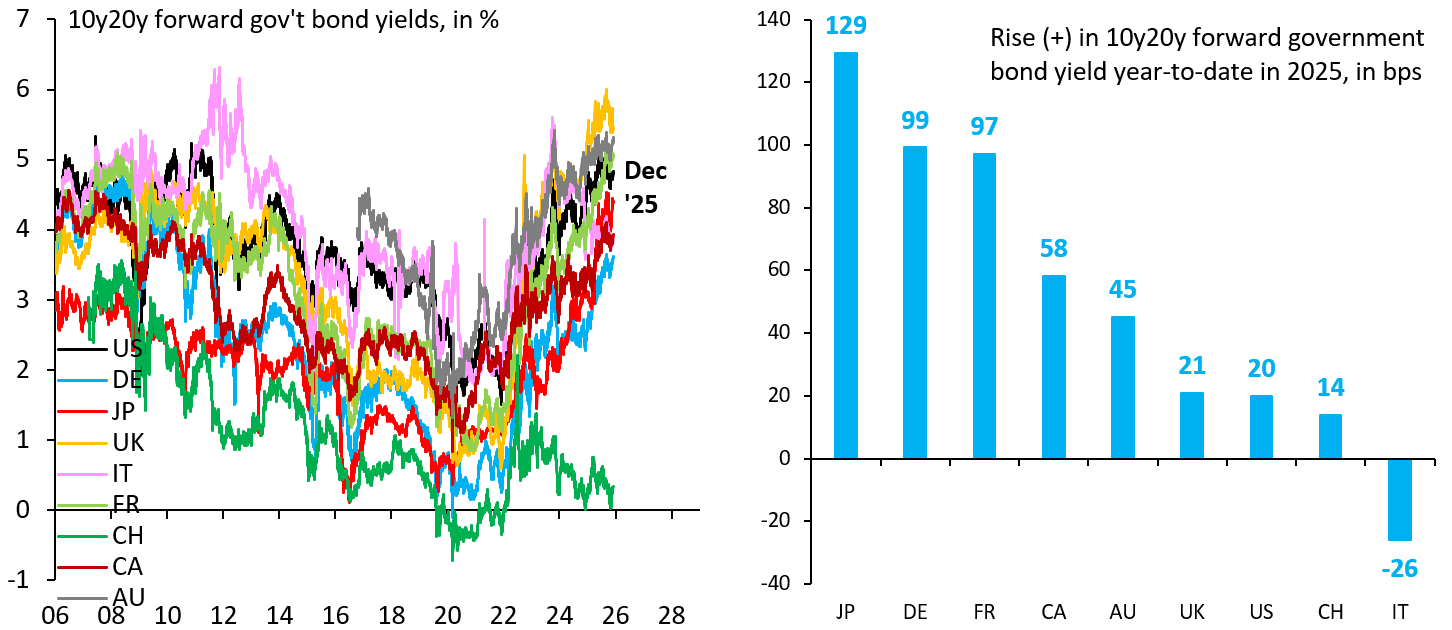

That leaves Fed rate cuts and “the best of a bad bunch” as explanations for falling yields. As I’ve noted in the past, looking at 10y20y forward yields removes cyclical noise from the short end of the yield curve, stripping out rate cutting (or hiking) expectations. As a result, these yields provide a “cleaner” read of what’s going on with long-term yields. The left chart above shows these 10y20y forward yields across key advanced countries and the right chart shows how these yields have changed in the course of 2025. What’s notable is traditional safe havens like Japan and Germany have seen big increases in long-term yields. This makes Treasuries an attractive safe haven on a relative basis and - in my opinion - is the main reason US Treasury yields are down this year. The US is the best of a bad bunch and that isn’t going to change any time soon.

Good article as always !! What’s concerning for me is that the very foundation of this crucial market has become increasingly fragile. A surprisingly large share of the Treasury market is now effectively held together by hedge funds running basis-trade arbitrage. This is one issue versus another, cash bonds versus futures, or even versus interest-rate swaps. It’s a structure that functions smoothly only so long as volatility remains contained and funding stays abundant.

Everyone understands the market is vulnerable to a correction. But when the plumbing itself is stretched thin, the risk is not of a gentle repricing, more like a vacuum drop. A stressed funding environment, a spike in volatility, or a temporary breakdown in arbitrage capacity could turn a routine adjustment into a fireball.

I should add the caveat that I spent years as a U.S. Treasury market maker, so perhaps I’m predisposed negatively to see the cracks. But the structural weaknesses are real, and the scale of borrowing now required makes them harder to ignore.

Really insightful analysis on the relative safe haven dynamics at play here.

Your point about 10y20y forward yields stripping out cyclical noise is particularly sharp becuase it reveals something the headline numbers obscure. While most focus on deleveraging or Fed expectations, the deterioration in traditional safe havens like Germany and Japan creates a gravity well effect for capital flows that's self-reinforcing in the near term.

One thing worth considering though is whether this "best of a bad bunch" premium actualy makes US debt sustainability worse. If Treasury yields stay artificially supressed relative to fiscal realities, it removes the market discipline that might otherwise force consolidation. We could be building an even larger cliff for whenthe relative advantage eventually erodes.