How China gets around US tariffs

China has begun to transship goods to the US via all kinds of third countries

In the three years since Russia invaded Ukraine, German exports to out-of-the-way places like Kyrgyzstan and Kazakhstan have picked up massively. That’s not because these places suddenly began to boom, with demand for German goods going through the roof. Instead, it’s a sign that Russia is importing German goods - mostly cars - through these places, i.e. Russia figured out how to get around Western export controls by importing Western goods via third countries.

It should be no surprise that the same thing is happening with China now in the face of US tariffs. China this week is about to publish its trade data for the month of May, but April data already showed a big rise in exports to all kinds of places. Most of these goods are likely to be transshipments designed to circumvent US tariffs.

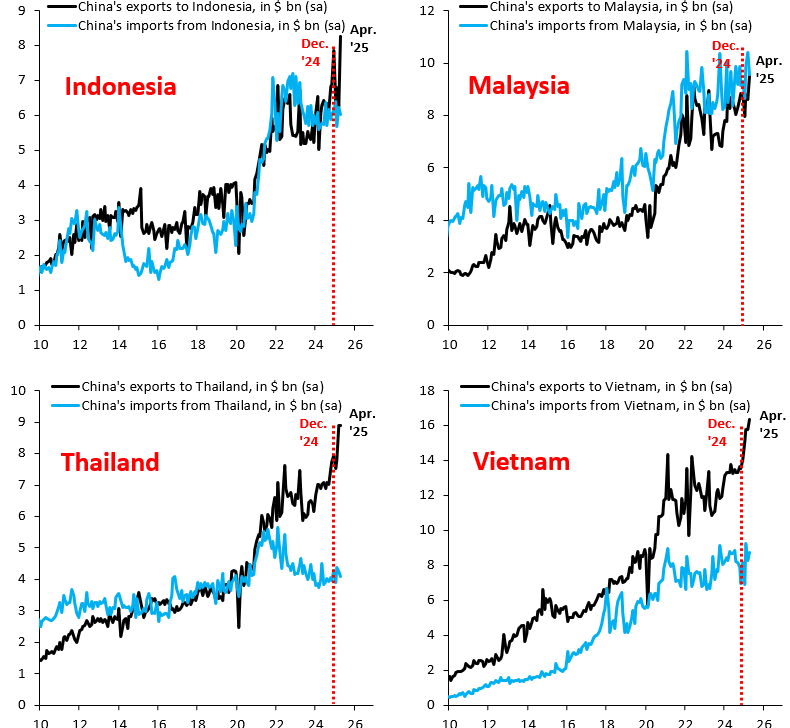

The charts show China’s exports (black) and imports (blue) to and from various countries in Asia: Indonesia (top left), Malaysia (top right), Thailand (bottom left) and Vietnam (bottom right). In all cases, China’s exports in April 2025 - the month in which US tariffs on China briefly went to 150 percent - reached new all-time highs, while imports remained subdued. Much as in the case of Kyrgyzstan or Kazakhstan, it’s not like domestic demand in these places started to boom with the escalation of the US - China trade war. The opposite is the case. This is - in all likelihood - evidence of big transshipments that are seeking to circumvent US tariffs.

A couple of conclusions are warranted. First, this doesn’t mean that US tariffs on China don’t work. These transshipments are painful for Chinese exporters, because it becomes more costly to export to the US, with transportation costs rising. That likely eats into margins and profitability of Chinese firms. Second, the underlying truth is that the US is the world’s biggest source of demand for goods and China is the world’s biggest supplier. These two forces have to meet, whether US tariffs go up or not. In the face of tariffs, transshipments are thus an inevitable reality. If the US really wants to decouple from China, it needs to cut domestic demand, which a consumption tax or VAT would do (something that would be desirable for all kinds of reasons, least of all the unsustainable fiscal trajectory in Washington).

The bottom line is that if the Russians can figure out how to get their hands on German cars - even in the face of export controls - China is certainly smart enough to get its goods to the US. The underlying issue in the case of Russia is that the West didn’t do enough to hurt Russia’s purchasing power (which it could have done with a lower G7 oil price cap). The situation with China is similar. If US demand remains strong, Chinese goods will find a way here.

With respect, I think that it is far too early to draw any conclusions on this issue.

I’m in merchant shipping, involved in running container ships. It would take much more than one month to re-

route a supply chain - particularly a component supply chain - through a third country.

I recommend waiting and seeing after six months.

Junk claim. ALL of those countries have been increasing trade with China for years, and the latest bump is nothing of particular notice. In fact over the past 10-20 years, just about EVERY country has vastly increased trade with China, and most of growth predates Trump's latest sanctions.