Lessons from Turkey for the US

Leaning on your central bank - as Turkey shows - can end in economic disaster

The Federal Reserve is under pressure from the White House to cut interest rates. Such instances of political pressure on central banks abound in emerging markets (EM) and - invariably - end in disaster. Of course, the US is far from being an EM. Institutional integrity is stronger and decades of good policy mean there’s lots of credibility that will take time to erode. But the “exorbitant privilege” of the US isn’t limitless, which the increasingly worrying fall in the Dollar underscores. If political pressure on the Fed continues to build, Dollar depreciation could accelerate, which would add to the inflationary impulse from tariffs. That could ultimately necessitate higher - not lower - interest rates.

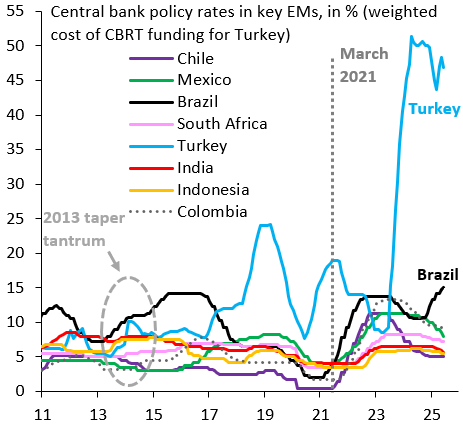

The recent experience of Turkey is instructive in this regard. In March 2021, President Erdogan fired Naci Ağbal, the hawkish central bank Governor he’d only appointed in November 2020. As the chart below shows, Ağbal’s successor quickly cut interest rates and what followed was economic disaster. Turkish Lira fell 50 percent in the remainder of 2021, entering a depreciation spiral from which it has yet to recover. Inflation soared and - you have to appreciate the irony - the central bank ended up hiking interest rates far more than Naci Ağbal ever did.

Several lessons emerge. First, leaning on your central bank to cut interest rates is deeply counterproductive. It can send the currency into a depreciation spiral, which may cause inflation to soar. Ultimately, this can force the central bank to hike more than it ever would have, had it just been left alone. Second, the damage from this kind of episode is long-lasting and very difficult to reverse. Turkey is still trying to dig itself out from under this policy mistake. It remains an open question whether it ever will. Third, political pressure on central banks to cut interest rates is a symptom of other imbalances in the economy. In the case of Turkey, President Erdogan had for years been using the banking system to run the economy hot, which is what was causing high interest rates. This is the policy imbalance that should have been fixed instead of firing Ağbal. In the case of the US, fiscal policy has been unsustainably loose for many years. This is what needs to be fixed, instead of leaning on the Fed.

When one posts as regularly as Robin Brooks — a good thing — and as narrowly focused as he has done recently on the US dollar — an important topic — it would help for him to step back occasionally and take stock of the different threads of his central argument of why the currency is trading as it is.

He was clearly not sympathetic to rival arguments that it was the gradual loss of its supreme international reserve currency status or, relatedly and equally damagingly, the loss of Fed independence due to harassment from a meddling White House. On the contrary, he argued it was due to the currency (and bond) markets misreading the state of the US economy. We’ll see about that.

Yet he has turned to those earlier rival arguments which he had earlier dismissed and returned with oddly prescriptive statements. First, the US must strive to maintain its global currency dominance by adopting a hawkish defense stance. Second, we have much to learn from the mistake of EM central banks who were forced to surrender independence. Are these mere precepts? Or are they genuine risks? I think we should be told (in the memorable words of the British satirical magazine, Private Eye).

At the risk of overinterpreting what Brooks’ views are on these topics, it seems to me that he wants to take us back to the early Reagan era — big defense budgets and tight monetary policy, thus a super-strong dollar. Yet, he ends his most recent post by admonishing the US government for not attending to its fiscal incontinence.

These contradictions need to be resolved. Otherwise, octopus-like, one is simply shooting jets of obfuscatory ink.

When I came to US I didn’t expect one day I would be studying if US would turn into… Turkey.