Predictions for 2026

Dollar weakness, Euro zone deflation, EM and the debasement trade do well

Welcome to 2026. I wish all my readers health and happiness for the year ahead. Thank you for subscribing to my daily Substack. In today’s post, I’m going to lay out what I see as the key market moves for the year ahead, which I’m going to lump into four broad categories: (i) Dollar weakness, as the Trump administration focuses on the midterm elections and leans on the Fed to cut interest rates more aggressively; (ii) Euro zone deflation, as GDP flatlines and activity falls below potential, a replay of what happened after the sovereign debt crisis in 2011/12; (iii) emerging markets (EM) continue to rally as central bank independence and institutional quality continue to erode across advanced economies, blurring the lines between the G10 and EM; (iv) the debasement trade continues to roar ahead, as markets seek safe havens from what is an increasingly dysfunctional and unsustainable global equilibrium.

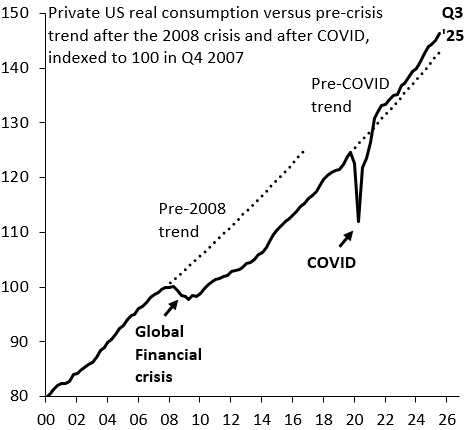

Dollar weakness: the Dollar rose massively in the decade before the COVID pandemic, powered by US outperformance vis-à-vis its G10 peers. US growth is still outperforming everyone else - the chart below shows GDP rising above its pre-COVID trend - but what’s different now is that the Fed is easing into this boom. That’s toxic for the Dollar, because it means that nominal (and real) rates will fall relative to the rest of the world. That’s not to say that other US assets will do badly. Low real interest rates are good for the stock market and I fully expect the S&P 500 to do well. Financial conditions will be extremely loose, which may of course be the plan into the midterm elections later this year.

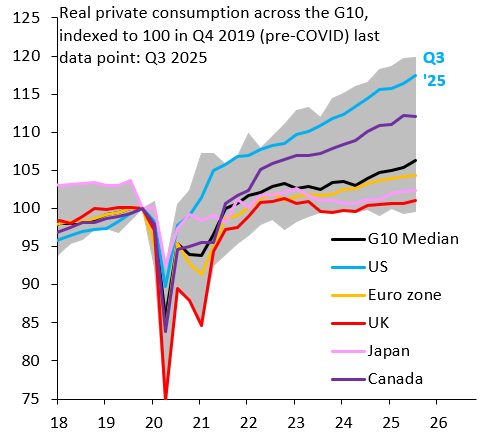

Euro zone deflation: debt overhangs that caused the sovereign debt crisis in 2011/12 never got resolved. Instead, they got papered over by the ECB, which is increasingly morphing into a fiscal assistance agency, ensuring low yields and market access for high-debt countries. Preventing debt crises allows politicians to muddle along, but the avoidance of crises doesn’t free up fiscal space. Only debt reduction can do that. The fact that certain countries have maxed out their fiscal space means the Euro zone remains paralyzed on key decisions, because everything descends into a tug of war over joint EU debt issuance. That’s the same equilibrium the Euro zone was in before the pandemic and means that inflation will start drifting back down towards zero. As the chart below shows, real private consumption in the Euro zone has already begun to lag the US in a very material way. Output gaps are opening up, which will weigh on inflation. None of this is politically sustainable. The far right is rising, most critically in Germany, which makes the end of this equilibrium - and the Euro - inevitable. My recommendation has been for Germany to disrupt this equilibrium before that occurs, including by threatening to leave the Euro. If the end is inevitable, better to have an orderly dissolution than a disorderly one.

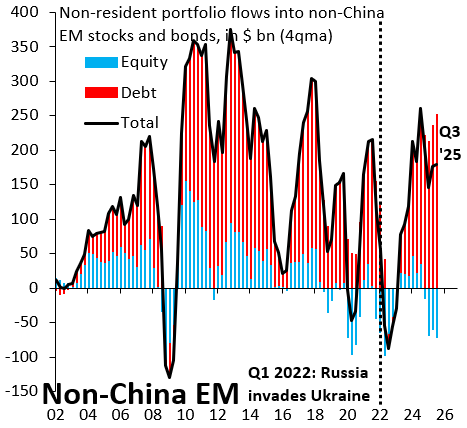

Emerging markets gain: the distinction between advanced economies and EM has always rested on the quality of institutions and that is very obviously eroding. That isn’t exclusively a US issue. The ECB - as I discuss above - is increasingly under the influence of high debt countries, which is really just fiscal dominance. The Bank of Japan remains a large gross buyer of Japanese government debt, without which yields would be much higher and Japan would be in a debt crisis. There’s all kinds of erosion of institutional quality and data across the G10, which blurs the dividing line between the G10 and EM. That’s fundamentally positive for EM, which is why - as the chart below shows - capital flows to non-China EM have been so incredibly strong.

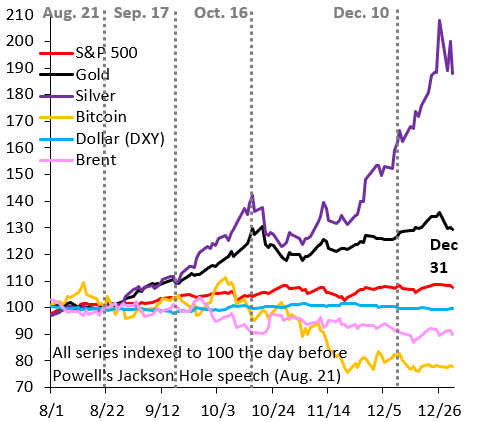

The debasement trade roars ahead: this trade was the defining feature of 2025 and reflects fear that unsustainable debt burdens across many advanced economies will be inflated away. The debasement trade is about the search for safe havens from this debt monetization and doesn’t just include precious metals but also the currencies of any and all low debt countries. There’s obviously going to be many ups and downs to this trade. The underlying driver is the fear that retirement savings will be inflated away, which makes the debasement trade prone to bubbles. But my basic view is that this thing has only just gotten started, after - as the chart below shows - already totally crazy gains in 2025.

Happy New Year, Robin. A sharp roadmap as always.

Your point on the EM Rally (iii) is particularly fascinating. You attribute the blurring lines to eroding institutions in the G10.

From my vantage point tracking the industrial flows inside China, there is a second, physical driver for this EM boom that supports your thesis: The rise of "Shadow Factories."

Much of the capital flow into "Non-China EM" (Vietnam, Mexico, Hungary) is actually the R.I.C.E. System extending its supply chain borders to bypass trade barriers.

What looks like "De-risking" in the data often looks like "Re-routing" on the ground.

These EM nations are becoming the assembly nodes for Chinese intermediate goods.

So, you are absolutely right to be bullish on EM, but perhaps not just because they are "catching up" to the G10 institutionally, but because they are integrating with the world's most efficient industrial engine.

In 2026, the trade might be: Long EM = Long the "derivative" of China's manufacturing base.

Looking forward to your analysis this year!

If the dollar falls (not dramatically, but consistently) against other fiats, do you think those countries will tolerate it? They have to keep their export machines humming and pay their own debts, they cannot tolerate their deflation (which a fall of dollar means, as America would get cheaper putting price pressure everywhere). So I suspect other countries (emerging or not) will only respond by easing their own to arrest the fall of the dollar.