The Dollar is not looking good

I've been way more positive on the Dollar than most, but now I'm starting to worry

My very first Substack post was on May 10, when Dollar bearishness was in full swing. This was just after the chaos of the reciprocal tariff rollout in April and the Dollar had fallen sharply. Overwhelming consensus was that this was only the beginning, that a major realignment in global currencies was underway, with the Dollar ceding its place as the world’s dominant reserve currency to others, most notably the Euro.

I argued loudly against that. It would have been one thing if the April fall in the Dollar had been about markets demanding a higher risk premium to invest in the US, but that’s not what happened. Instead, markets traded tariffs as a policy mistake, one that would backfire on the US and cause recession. As a result, market pricing for the Fed became more dovish and rate differentials moved against the Dollar. I disagreed with much of this, but - more importantly - none of this was about reserve currency status or anything structural like that. Markets were simply trading a cyclical story that - as it turned out - would be proven wrong in fairly short order. The US never went into recession, which is why the Dollar stabilized by the middle of the year.

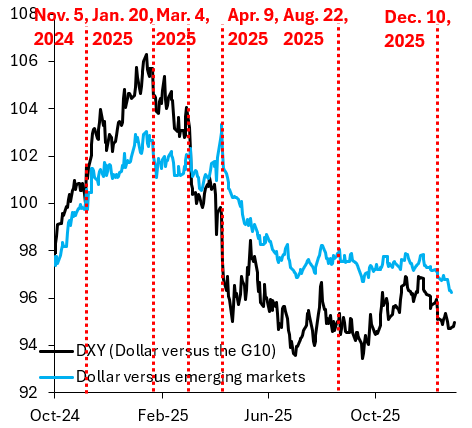

The chart above is an updated version of what I showed in my first post on May 10. It shows the trade-weighted Dollar against the G10 (black line) and the trade-weighted Dollar against emerging markets (EM). I argued in that post that the Dollar versus EM is a better reflection of how weak or strong the Dollar is, because Germany’s fiscal stimulus announcement in early March caused the Euro to appreciate, making the Dollar look weaker than it really was. Eliminating this kind of noise by looking at the Dollar versus EM cuts this year’s fall in the greenback in half. There never was a free fall and the fall that did happen was modest.

As markets capitulated on their recession call, the Dollar stabilized and traded in a relatively narrow range, especially against EM. But this has changed recently, which is what has me worried. Ever since December 10, when the Fed cut its policy rate for the third time this year, the Dollar has been falling against EM and has broken below the narrow range it traded in for much of the year. These kind of things matter. One of the big puzzles of 2025 is that markets ignored President Trump encroaching on the Fed. It wouldn’t be unreasonable for markets to now start zeroing in on this as we near 2026. All this is making me more cautious on the Dollar, in contrast to consensus which has become more bullish.

Thank you for the post. What do you think about the prospect of the US invariably lowering rates or allowing inflation to run hotter than 2% as a response to address the debt concern?

Annual interest payment is now almost 15% of annual federal budget. There’s only 3-4 times in history that’s happened. Every time, financial repression, lowering rates, inflation happened, whether deliberate or not. It appears that such measure are convulsive responses. Could be similar this time?

Interesting thanks Robin - I have been bullish EURUSD, but now the CFTC positions seem to agree with me. It struggles to beak 1.18 with the usual US Corporate USD demand it seems. AUDUSD CFTC positions even more so. USDCNH is lower because of Corporate selling of USDs, and as you say, this has lead to lower USDZAR etc. Banks are, ono the whole, bullish AUD into the New Year (why not - RMB stronger, China probably cut rates) - one small issue would appear to be the local pension funds, who do not appear to be adjusting hedge ratios. The JPY is destined to remain weak - given BOJ credibility, and the long end issues you point out - I don’t think they intervene in the currency market (famous last words - but their comments have stabilised the market for now). US NFP data may provide some clarity for the broader USD, and lead the market to expect the Fed to cut at the end of January. I remain bullish EURUSD, like EURJPY to 195, buy dips in Gold (I am sure China will continue to recycle their surpluses there), wait to buy the AUDUSD; Cable, there is still some short positioning, so that could surprise us all. USDCHF & EURCHF, the SNB have them well in control

Selective EM probably continues to do well since I think three will be allocations into EM Credit from US Corp credit. BRL looks relatively cheap now,