The EM Growth Crisis

Emerging markets ceased growing more rapidly than the US about a decade ago

The main rationale for investing in emerging markets (EM) is that they’re supposed to grow more rapidly than the G10. Faster growth should translate into higher rates of return on investment, which is supposed to attract capital inflows from abroad. The problem is that EM stopped outgrowing advanced economies about a decade ago. In recent posts, I highlighted idiosyncratic trouble spots like Mexico and Latin America, but really this is a broader phenomenon that engulfs almost all of EM. In fact, the few countries that aren’t affected are places like Turkey, which used one credit expansion after another to artificially boost growth. That experiment caused lots of volatility and substantial debasement of the Lira, so there’s clearly no easy way out of this growth trap. What’s needed are structural reforms to liberalize labor and product markets as well as measures to safeguard democracy. I have little faith these kinds of things will happen. EM is trapped in the same descent into populism that’s also playing out across advanced economies.

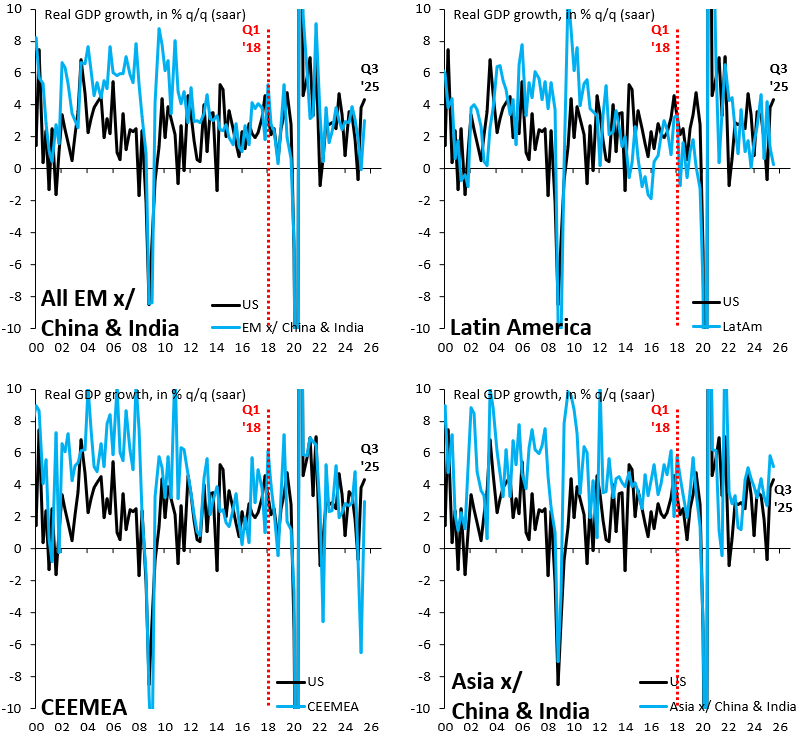

The black line in the charts above shows quarter-over-quarter growth in the US on a seasonally adjusted, annualized basis. The blue lines are the same growth rate for all EMs excluding China and India (top left), Latin America (top right), Central and Eastern Europe, the Middle East and Africa (bottom left) and Asia excluding China and India (bottom right). I exclude China and India from the EM total and from the Asia grouping because both countries are so large they drown out the smaller ones.

These charts show that growth has slowed on a broad basis across EM, so this isn’t just about a few bad apples. In fact, the growth slowdown is playing out across all regions, so it isn’t just about Latin America either, as I flagged in yesterday’s post. At best, like in Asia, growth is on par with the US, but in Latin America and increasingly in CEEMEA it’s falling below that in the US. Capital flows to EM were unusually strong in 2025, but - with this going on below the surface - I don’t see how this can continue. The basic premise for investing in EM - high growth - is being undercut.

I’d say that the basic premise for investing in EM is higher growth of nominal dollar GDP, not high real GDP growth in domestic currency. And in that respect, I‘m not that worried. In fact, after a few years of comparably weak performance, EM debt and equity markets are starting to shine again. The MSCI Emerging Markets Index delivered a total return of 26.7% in USD for 2025, outperforming the S&P 500’s 17.9% total return. I think this trend will continue in 2026.

Sharp point about labor market liberalization being the missing piece. I've spent time tracking EM structural reforms, and there's a clear pattern where countries that moved toward flexible hiring/firing frameworks saw investment inflows shift meaningfully. But the political economy is brutal because those reforms usualy generate short-term job losses before productivity gains show up. Most goverments can't survive that window, so they opt for populist credit expansion instead, which as Turkey shows just defers the pain while making it worse. The fact that growth stalled a decade ago across almost all EM regions tells me this isn't fixable without some external shock forcing the issue.