The Global Race to the Bottom

G10 economies are becoming more EM-like, which explains the rush for safe havens

In recent weeks, my posts have documented an alarming confluence of things: (i) a global rise in longer-term bond yields; (ii) drastic outperformance of safe haven assets like gold; and (iii) a US Dollar that’s been remarkably stable against its G10 peers. The common factor in all these moves is that markets seem to be trading debasement of many G10 currencies - not just the Dollar - as countries across the G10 succumb to simplistic populism, reckless fiscal policy and fiscal dominance of their central banks.

The “plan” was always for emerging markets (EM) to converge up to G10 status. But instead it looks increasingly like many G10 economies are converging down to EM status. This process has only just begun and will take many years to play out, but it will make life a lot more difficult for EM. After all, it means that the yield advantage of EM versus the G10 gradually erodes. G10 investors will have plenty of risk premia to harvest at home, which will make it harder for EM to attract capital inflows.

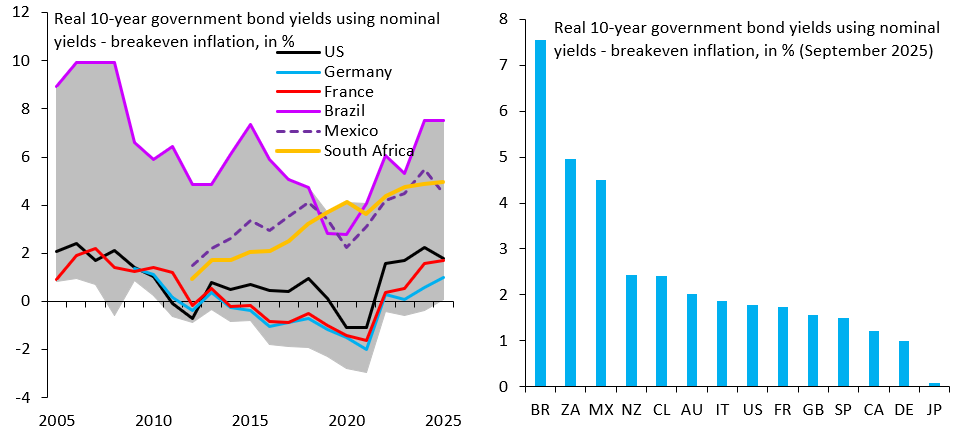

The two charts above show market-implied real 10-year yields across the G10 and EM. The left chart shows the evolution over time of these real yields, while the right chart shows a cross-section of these yields as of yesterday. Real yields in EM are a lot higher than in the G10, so we’re still in the early stages of this process. But the dividing line between EM and G10 is already getting blurred. Take the example of Chile (CL) that already has a lower real yield than New Zealand (NZ). As markets start to price more and more G10 dysfunction, these kind of cross-overs will become more frequent.

This trend towards G10 debasement or EM-ification has big market implications. It means that safe havens, whether gold or low-debt countries like Switzerland, may see a drastic repricing as investors look for places to hide. It also means that the EM yield advantage - historically the main reason to invest in EM - will erode, making it even harder for EM to attract foreign capital inflows. EM will become less “special” as the G10 converge down.

Think the key distinction here isn’t ‘EM’ vs ‘DM’ but saver economies vs dis-savers. Just the long postulated but much ignored idea that NIIP-positive economies’ currencies cannot be continuously under-valued after accounting for carry costs.