The Mistaken Myth of an Invincible China

The widespread view that China has the upper hand over the US is nonsense

China this week put new export controls on rare earths and other critical minerals needed for US defense and technology production. This step drastically escalates the tariff stand-off with the US and fits neatly into the widespread narrative that China has the upper hand over the US. That narrative is nonsense.

China’s economy is hugely dependent on its export sector, which has suffered a body blow as a result of US tariffs. You just have to look at China’s export data to see this. Direct exports to the US have fallen sharply, but exports to the rest of the world are up by an equal amount. China therefore still exports the same amount of stuff, it’s just that this stuff is either going to new markets (trade diversion) or to the US via third countries (transshipment). Either way, China’s exporters are likely seeing a sharp drop in their profitability, as both options involve reduced margins via price discounting or higher transportation costs. China may well be escalating the tariff stand-off with the US because its exporters are hurting and running on borrowed time. China is everything other than invincible.

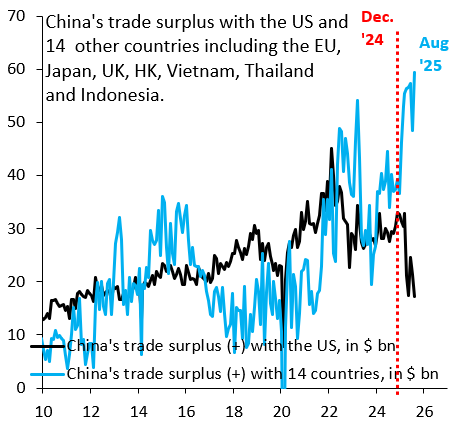

The chart above uses monthly Customs Bureau data to construct China’s trade surplus with the US (black line) and with 14 of China’s other major trading partners (blue line). These data are seasonally adjusted by the source. It’s clear that China’s trade surplus with the US has fallen sharply, but it’s equally clear that China’s trade surplus with its other major trading partners has - at the very least - fully offset that drop.

On the surface, this again feeds into the narrative that China has the upper hand over the US, but that’s a misreading of this chart. If trade diversion is driving the rise in non-US exports, these goods must be discounted to generate demand in markets where demand didn’t previously exist. If this is transshipments, it means higher transportation costs as goods go through third countries instead of to the US directly. Either way, China’s export sector is likely seeing a substantial hit to its profitability. This means that China may be using rare earths to escalate the stand-off with the US because it has no other choice. The hit to its export sector is just too considerable, making it necessary to raise the stakes in an effort to bring US tariffs down.

I agree that China is hurting. If they weren't, why would they cause a crisis that exposes the dangerous consequences of dependency on China for its customers. If they succeed in the short term in forcing customers to start buying from them, they lose in the long term as customers diversify their suppliers. A longterm losing strategy is an odd thing for the winning side to embrace.

The premise here is straightforward: “if you can afford to produce it, you can afford to consume it” — as simple as that. China is doing fine; the real struggle lies on the US side, as it continues to import rerouted Chinese goods — at a higher price — despite all the sharp rhetoric. If the US is serious about finally walking the walk rather than just talking the talk, it should bring all of that to an end. But it can’t, because there is no substitute — China remains the only game in town. Let’s see how much of that inflation US consumers are able to stomach!