The Tariff Inflation Shock is Coming

US tariffs are an inflationary impulse for the US, but a deflationary one everywhere else

At the height of COVID - more or less exactly five years ago - global supply chains went into cardiac arrest. Delivery times of manufactured goods spiked everywhere, setting the stage for a global inflation shock that peaked in 2022.

What’s going on now is similar and different. Tariffs are clearly an inflationary shock for the US, a big net importer. But they’re a deflationary shock for much of the rest of the world, especially the Euro zone and China, which are big net exporters of goods to the US. Unlike COVID, when the inflation shock hit everyone similarly, the opposite is true now. This is starting to show up in data, which I discuss in today’s post.

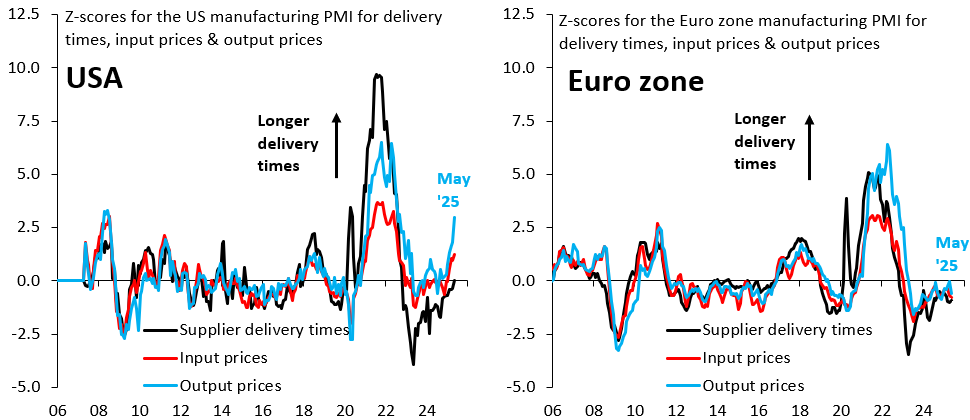

The global manufacturing purchasing manager indices (PMIs) are monthly balance-of-opinion surveys run by S&P Global. During COVID, these surveys became widely used and followed, because they asked factory floor managers about delivery time delays they were seeing. The left chart shows these delivery times for the US, while the right chart shows the Euro zone (black lines). I’ve transformed these series into Z-scores, which means they’re expressed in standard deviations from their historical mean. A reading of 10, which the US had after COVID, means delivery time delays were 10 standard deviations above normal levels, a huge shock.

Both charts also show output (blue lines) and input (red lines) prices. Output prices are what companies charge customers. Input prices are what they pay suppliers. Both are again expressed as Z-scores. What’s notable is that output prices are clearly rising in the US, where - so far - the shock is already half as severe as COVID. In contrast, there’s no sign of an inflation impulse in the Euro zone. If anything, the output price Z-score is still in the same negative place it went to after COVID dislocations ended, so deflationary dynamics remain in play. It’s also notable that - unlike COVID - there are no meaningful delivery time delays at this stage.

The fact that inflation dynamics are so divergent runs counter to recent Dollar weakness and is thus of great importance for markets. Interest rate differentials have moved sharply against the Dollar since the imposition of tariffs. Preliminary data do not validate this move. I’ll spend much of the coming week looking at what markets price versus what fundamentals say about the global economic picture.

Thank you. Concise, clear, rational. Looking forward to the follow-ups!

To summarize: not only is China fine, other exports are more affordable leading to increased pressure on industries in America while American exports and growth suffer (greater cost of capital). I don’t see how any of this was ever supposed to help with the current account deficit. Or Taiwan.