The tariff shock to US inflation is massive

Inflation for goods predominantly imported from China is running far above normal

There’s many rationalizations that are given for why the Dollar has fallen so much this year. But - at the core - all these rationalizations boil down to a fairly standard macro story, which is that tariffs didn’t push up inflation as fast or as forcefully as expected.

This is changing. As I flagged in a post two weeks ago, CPI inflation is rising rapidly for goods that are predominantly imported from China. The tariff inflation impulse took longer than expected to show up due to tariff front-running and transshipments, but it’s now hitting with a vengeance. This post updates my analysis for yesterday’s PCE release for June. Inflation for goods predominantly imported from China is running extremely hot.

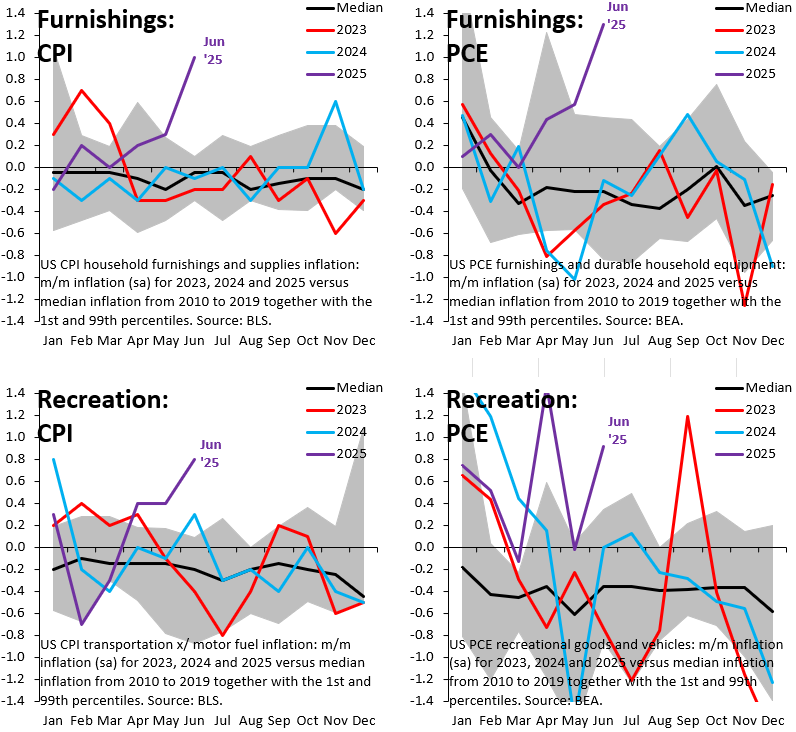

I focus on two categories of goods - furnishings and recreational goods - which make up 25 percent of “core” goods in the CPI and PCE inflation baskets. Furnishings is a broad category that includes furniture, household appliances as well as tools and hardware. Recreational goods include everything from video and audio products to sporting goods and pet supplies. Both categories of goods are heavily imported from China.

The top row of charts shows the path of monthly inflation for furnishings in the CPI (lhs) and PCE (rhs), while the bottom row shows the monthly path of inflation for recreational goods. In all cases, monthly inflation in June 2025 (purple line) is running between 100 - 120 bps above where it would be normally at this time of year (black line). The inflation impulse from tariffs is massive and building.

As of today, markets price 38 bps in cuts from the Fed for the rest of 2025. That’s down from over 50 bps just a few days ago, which is one reason why the Dollar has risen so much in recent days. But there’s scope for markets to revise their view still further given how big the inflation impulse from tariffs is. It’s conceivable the Fed doesn’t cut at all this year, which means the Dollar may rise a lot further.

Great analysis.

I would just add that, once unemployment—the other end of the Fed’s mandate—is factored in, it becomes even more likely that Powell will stay put for the foreseeable future.

The DXY is likely to move higher, driven by interest-rate differentials, underlying fundamentals, and geopolitics.

No matter how high Trump's tariffs are, they are small in the context of a $30T economy and, in any case, inflation is always and everywhere a monetary phenomenon. MV = PQ. Only changes in one of these four variables can affect the price level, nothing else.