Things that are weird about 2025

There's so much that's weird about macro in 2025 - here's a list of the biggest things

This year is crazy and I’m just talking about what’s happened in financial markets and the global economy. We all get caught up in the daily noise of data and market moves, so this post takes a step back and lists the things that strike me as super weird. There is so much that’s strange about 2025 that I’m sure I’ve missed stuff, so please send any additional thoughts my way. I’ll work on updating this list regularly.

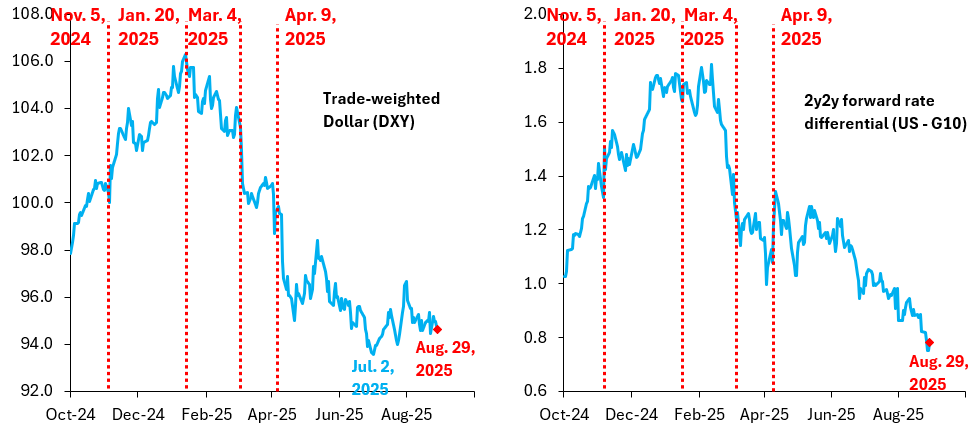

The Dollar has fallen substantially. This is super weird, because any economic model says the Dollar should have risen due to tariffs. After all, tariffs are a negative shock on the rest of the world, which markets should at least partly offset by driving the Dollar up. As the left chart below shows, the opposite has happened. The trade-weighted Dollar is down 10 percent since the start of the year. The prevailing explanation for this is that markets are pricing a risk premium to reflect erratic US policies. That’s not true. As the right chart shows, the fall in the Dollar is explained almost entirely by rate differentials moving against the Dollar. Markets seem to think that tariffs will boomerang on the US, with recession forcing the Fed to ease a lot more than other central banks. This is all super weird. After all, tariffs are inflationary for the US and deflationary for the rest of the world. It’s odd for markets to price more easing in the US than abroad.

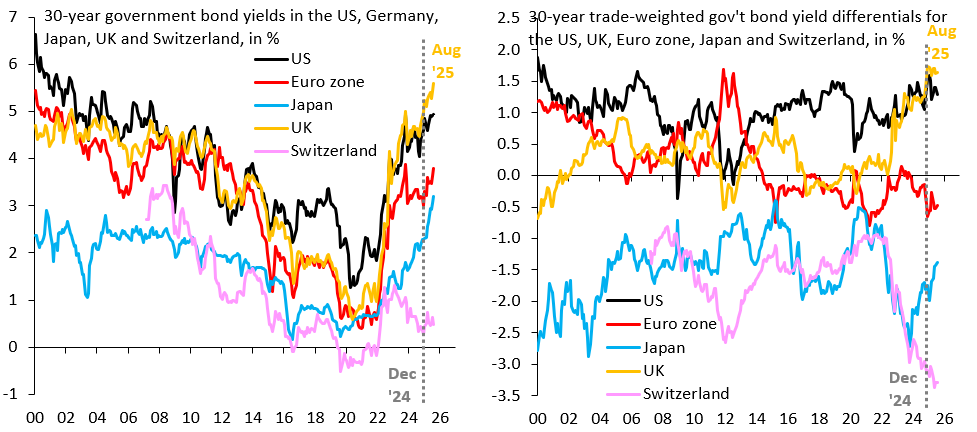

Long-term US Treasury yields price essentially no risk premium. Projected fiscal deficits are massive with no end in sight. Then there’s what looks like an all-out assault on the Fed. These things should push up longer-term Treasury yields, as markets price a higher risk premium. As the left chart below shows, there’s no sign that the 30-year yield for the US (black line) has risen more than elsewhere. In fact, when I calculate a trade-weighted differential of 30-year government bond yields in the right chart, the US differential is stable so far this year. I can better explain this weirdness than I can the Dollar fall. There’s so many fiscal basket cases out there - Japan, the UK, France and Italy - that the US still looks halfway decent on a relative basis. The bond market vigilantes are definitely out there, they’re just pushing up yields everywhere, not just in the US.

The tariff inflation impulse is fading. One of the lessons from US tariffs on China in 2018 is that the inflation impulse was modest. But that episode doesn’t compare well with what we’ve seen this year. After all, the Yuan fell against the Dollar in an almost one-for-one offset to tariffs, muting the inflation hit from tariffs. It’s the opposite now, given that the Dollar has fallen. The two charts below show the year-to-date path of month-over-month inflation in furnishings, one of the categories most heavily impacted by China tariffs. As the charts show, the inflation impulse in the CPI (left chart) and the PCE (right chart) is fading rapidly, which is baffling. The best rationale for how this could be happening is that passthrough from tariffs into inflation is non-linear and backloaded. But - as I wrote in a recent post - there’s indications that tariff-led inflation will moderate further in data for August.

Tariffs don’t seem to have caused any supply chain disruptions. The COVID shock caused huge supply chain disruptions, with delivery times in the US (left chart below) and the Euro zone (right chart below) rising sharply. I would have thought there’d be at least a little bit of this given the scale of US tariffs on China, but there’s absolutely nothing. This is perhaps the weirdest thing of all and I’m struggling to find any sensible explanation.

There’s a number of asset market implications from all this, but the most important one is this. All the evidence from inflation and supply chains says US tariffs are no big deal. If that’s true, then the Dollar shouldn’t have received the beat-down it got. So either tariffs are a big deal and the Dollar sell-off is warranted, or tariffs aren’t a big deal and the Dollar is substantially undervalued. I’m in the latter camp (no surprise).

I really like your commentary and I follow your posts closely. Your recent podcast on Macro Musings was also great.

One thing I don't understand is why strategists like to say Japan is in a terrible fiscal position -- even worse than the US it's often said. The fact is Japan almost balanced it's budget this year and is on track for a surplus next year. It's NIIP is massively positive -- Japan was the largest creditor country in the world for 34 years straight. Yes, there are a bunch of low yielding liabilities on the government's balance sheet but that is offset by higher yielding assets like GPIF holdings. It is also worth noting that it has been reported that the Japanese government is ultra conservative with their debt servicing costs, including in that figure extra to pay down debt. Compare that to the US with it's twin current account deficit and fiscal deficit, which is something like 7% of GDP with no end in sight. Are the two even in the same category??

Could it be that A) tariffs aren’t a huge deal and B) the dollar selloff is explained by anticipation of a relatively dovish Fed, not because of economic weakness from tariffs but due to political pressure from the admin?