Trends in Global FX Reserve Management

Global reserve managers have been shifting out of USD, but EUR hasn't benefitted

Yesterday’s post on the IMF’s latest reserve manager data (COFER) for Q2 2025 was a a dunderhead effort on my part because I forgot to adjust for FX valuation effects. I published a mea culpa yesterday afternoon, which previewed today’s post, in which I roll out a full suite of valuation-adjusted COFER shares starting from Q1 2017.

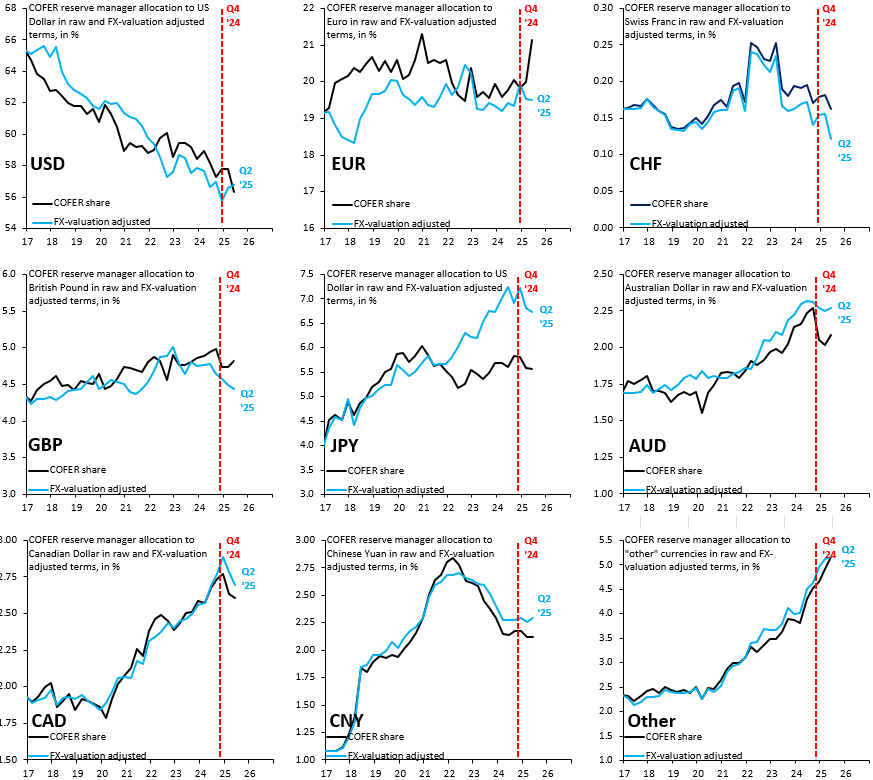

The big picture is that reserve managers have been gradually pulling out of the Dollar and shifting into other currencies. The Euro is - interestingly - not a beneficiary of this trend. Instead, the main beneficiaries are the Australian Dollar, the Canadian Dollar, the Chinese Yuan and the “other” category in the COFER data, which lumps together many other currencies. The fact that the Euro has failed to make gains - even amid the turbulence of Q2 2025 - is a sign that skepticism towards the currency union may be high among reserve managers who tend to be risk averse and may be fearful of the medium-term survival of the Euro.

Each of the charts above shows the raw COFER allocation share (black) alongside my valuation-adjusted measure (blue). For the most part, the medium-term trends are the same across the two measures, but there can be differences, such as in Q2 2025, when the Dollar fell sharply. Adjusting for that drop and moves in other currencies, the key medium-term trends in COFER are:

There’s a medium-term shift out of the Dollar. This shift has been a steady trend in recent years that’s preceded Trump. In fact, reserve manager allocations to the Dollar have been stable very recently (top left chart), even with all the reciprocal tariff chaos.

The Euro hasn’t managed to capitalize on this Dollar exodus. Its share in global reserves is stable, especially adjusting for the large appreciation of the Euro against the Dollar in Q2 2025.

Beneficiaries of the USD exodus are AUD, CAD, CNY and the “other” category. More established currencies in the COFER survey - like GBP and CHF - have not benefitted. The only established currency with large, valuation-adjusted gains is JPY, something you don’t see in the headline COFER share because of the steady depreciation of the Yen against the Dollar.

It might seem counterintuitive that the Dollar hasn’t suffered a more recent exodus, given all the turbulence around “Liberation Day.” However, as I’ve flagged in recent posts, there’s many global trouble spots, including Japan, France and the UK, which make the US look relatively good on a global scale.

Preceded Trump but the chart only goes back to Trump 1?