Why are tariffs not lifting US inflation?

The rise in US inflation is coming, several factors are just temporarily delaying it

The whole point of tariffs is to lift imports prices, shifting US demand towards domestically produced goods. That effect should be especially pronounced given that the Dollar has fallen, which adds a further impulse to import prices, but this week’s inflation data failed to show any such effect. Inflation surprised on the downside and the Dollar fell sharply as a result. There are three reasons why this is happening - all of which are temporary - which means that the tariff impulse to inflation is coming. This also means that the Dollar is likely to have bottomed.

Three factors are holding down inflation currently. First, there’s always lags in the transmission of shocks to inflation. Companies front-loaded imports in anticipation of tariffs, which sharply widened the trade deficit earlier this year, so they’re currently selling goods that predate tariffs. This inventory will obviously be depleted quickly, so this effect is temporary. Second, China is aggressively using third countries in Asia to transship goods to the US, which is why its exports to Thailand, Vietnam and many other countries have risen so much this year. I wrote about this effect in one of my first posts over a month ago. Since this amounts to tariff circumvention, the US is unlikely to tolerate these transshipments, making this effect - again - temporary. Third, US inflation has “residual seasonality” since COVID, making it look worse than it really is in the first quarter, followed by a temporary inflation lull in the middle of the year. We’re currently in that lull, which is - again - temporary.

Many companies, especially those in the service sector, only adjust prices a few times a year. Most of these adjustments happen at the beginning of the calendar year, which is when many firms update their prices. When inflation is stable and low, these start-of-year price resets gets filtered out by seasonal adjustment, but the COVID inflation spike messed that up. Start-of-year price resets were much higher than normal, so some of this seasonality didn’t get filtered out, causing “residual seasonality” in US inflation data.

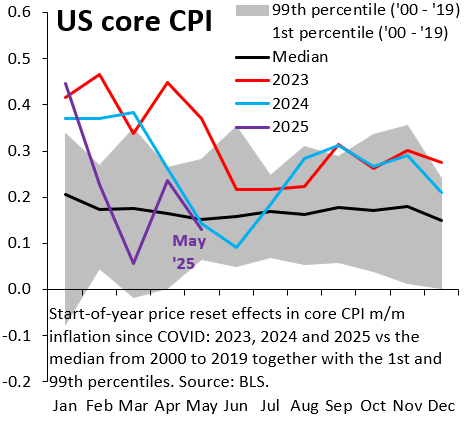

The chart shows what a big deal this residual seasonality has been since COVID. The black line is the historical median for seasonally adjusted month-over-month core CPI inflation from 2000 - 2019, i.e. in the two decades before COVID. As you’d expect for seasonally adjusted data, this line is essentially flat through the calendar year. The chart also shows monthly inflation readings for 2023 (red line), 2024 (blue line) and so far in 2025 (purple). Residual seasonality is pushing up inflation readings in the first quarter, followed by lower inflation readings in the middle of the year. We’re currently in that inflation “lull,” which is temporarily holding down inflation. This effect will fade as we move into the second half of 2025.

Recent Dollar weakness has been entirely driven by dovish expectations for the Fed, which in turn stem from downside surprises on inflation. If these downside surprises turn out to be a head fake - which they are in my opinion - this means the Dollar is likely to have bottomed. The tariff impulse to inflation is coming and - with that - the Dollar will rebound.

Interesting.

The conclusion does assume the Fed will remain strongly independent even after the new 2026 nominee though.

Inflation is always and everywhere a monetary phenomenon. Money growth has risen from -5% in 2023 to 4% now. Inflation continues to fall because of the lag between money growth and the price level. Tariffs are not a monetary phenomenon.