Why is the Dollar falling?

Interest rate differentials don't explain the fall in the Dollar, which is worrying

Currency markets are complicated. Exchange rates go up and down and it’s not always clear - even with the benefit of hindsight - why markets move one way or the other. In the end, once you filter out all the noise, fundamentals should be the key driver, which for exchange rates is interest rate differentials. These rate differentials capture market expectations for monetary policy in different places, with currencies that see their interest rates rise vis-à-vis their trading partners likely to strengthen.

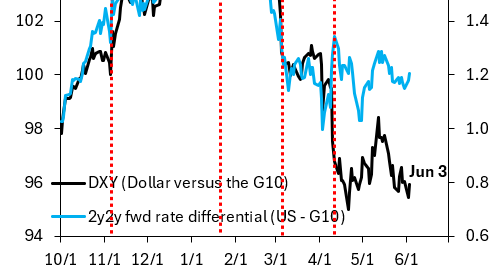

So here’s what’s odd. The Dollar (black line) has fallen sharply, especially since the 90-day pause of reciprocal tariffs was announced on April 9, while the trade-weighted rate differential of the US vis-à-vis the rest of the G10 has been stable (blue). As an aside, I look at the 2y2y forward rate differential here, which in my opinion is a good proxy for where markets think “terminal rates” for monetary policy will be, but my basic point - that rate differentials are stable while the Dollar is falling - is robust to different versions of this differential.

The most benign interpretation for this decoupling is that equity flows are the principal driver of Dollar weakness. Markets had bought into US “exceptionalism” and are now reversing themselves on that theme. This may see many foreign buyers cut their allocation to US equities. This is a cyclical re-assessment of the US growth picture, expressed via equities, which would explain why bond markets and thus rate differentials are a side show. The less benign interpretation is that negative animal spirits, which rate differentials fail to capture, are driving the Dollar down. This could, for example, be concern over US reserve currency status.

At this point, I am almost sure the decoupling is the former. Markets are noisy and currency markets especially so. Current Dollar weakness is therefore likely temporary. In my view, the Dollar is in a multi-decade strengthening cycle, which is far from over. More Dollar strength is coming.

Thanks, Robin. If Trump’s Bill passes in its current form (which perhaps looks increasingly unlikely), adding to the deficit as it is, do you still think the dollar is in a multi-decade strengthening cycle?

Have commented for you previously the hypothesis that markets are losing faith in US governance. We do not evidence the ability to move economic policy rationally in ways that can be anticipated. Thus, the dollar decline in opposition to fundamentals reflects both animalism (fear) and unease about the management of the reserve currency. I don’t think the reserve currency is in real danger, but there’s enough uncertainty to drive dollars down and yields up for our debt.