China's Deceptive Export Resilience

China's September export data look strong, but that picture is deceptive

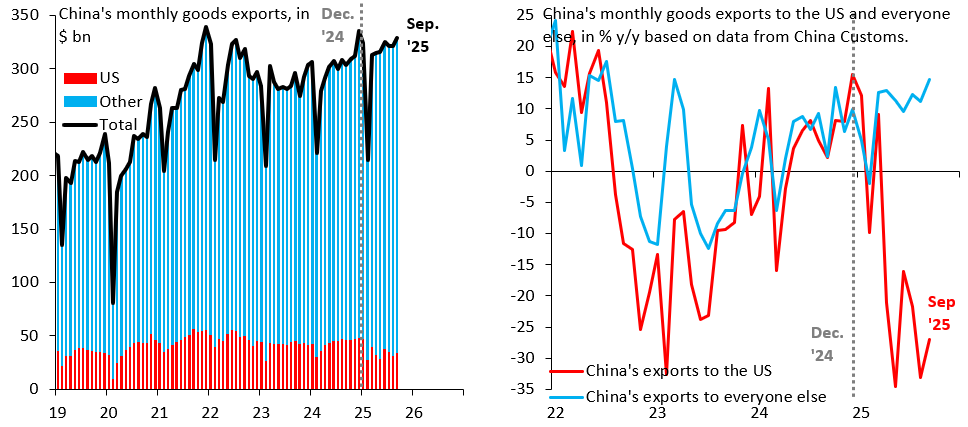

China’s customs agency just published September trade data, which once again paint a remarkably resilient picture for exports in the face of US tariffs. The fall in China’s exports to the US is essentially completely offset by rising exports to the rest of the world. These data feed the narrative that China has the upper hand in the trade war with the US, but that’s deceptive. Margins of China’s exporters are likely getting hit hard, as they’re making steep discounts to generate demand in new markets or facing higher transportation costs for transshipment to the US. Either way, China’s export sector is likely suffering through a very severe shock.

China’s September export values look healthy, as the left chart above shows. Beneath the surface there’s a massive rotation in exports away from the US, with exports to the rest of the world up sharply. The right chart zeros in on this. China’s direct exports to the US are down 27 percent year-over-year in September (red line), while its exports to the rest of the world are up 15 percent. This kind of rotation is possible only if China’s exporters are selling at steep discounts to generate demand for goods that previously went to the US. Alternatively, it’s possible that they’re sending goods to the US via third countries, in which case they’re having to accept higher transportation costs.

Either way, margins are getting hit, which means there’s a big negative shock lurking beneath the surface of these data. This is in my view the best explanation for China’s recent escalation of the trade war using rare earths. China is an export-dependent economy that’s on borrowed time. It’s hardball tactics on rare earths stems from weakness, not strength.