Financial Decoupling from China

Emerging markets are getting record capital inflows - but not China

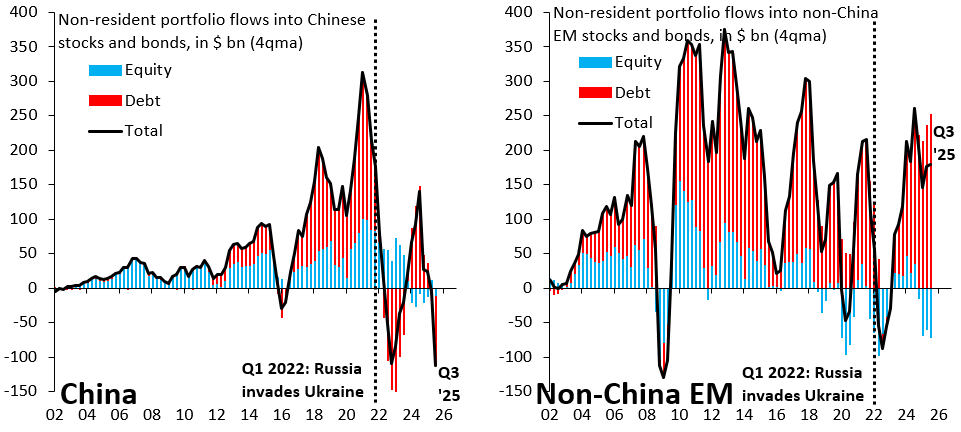

In the years leading up to the COVID, China attracted huge capital inflows, crowding out the rest of emerging markets (EM). This continued in the immediate aftermath of the pandemic, but came to a sudden halt with Russia’s invasion of Ukraine. As I noted in a post back in October, foreign money stopped flowing into Chinese markets after that, even as it continued flowing enthusiastically to the rest of EM. This decoupling has grown even more acute in recent data and - in my view - represents a structural break in investor behavior. After all, many EM investors got badly burned when Russia invaded Ukraine. No one wants to ride the same train for Taiwan.

The left chart above shows non-resident portfolio flows into Chinese stocks (blue) and bonds (red). The right chart shows the same thing for non-China EM, which consists of 24 other countries across Latin America, Central and Eastern Europe, the Middle East and Africa, plus non-China EM Asia. The last data point is Q3 ‘25, when tensions between the US and China over rare earths were building. This escalation may explain foreigners pulling their money out of China, likely a transitory phenomenon. But the bigger picture is that foreign money has been going enthusiastically to non-China EM since Russia’s invasion of Ukraine, while these flows have been almost flat for China over the same period. This is - in my view - a structural shift. China’s ceaseless saber-rattling over Taiwan is something markets no longer have patience for.

The divergence between China and non-China EM portfolio flows is striking, but I'd add that the structural break probably started earlier than Q1 2022. The regulatory crackdowns on tech and tutoring in 2021 already signaled that policy risk was being repriced. The Ukraine invasion accelerated an existing trend rather than creating a new one. What's intresting is that this decoupling is happening while China still offers liquidity depth that most other EMs can't match. The fact that investors are walking away despite that suggests this isn't just about geopolitical tail risk but about fundamental doubts on property rights and regulatory predictability. Non-China EM's benefiting here feels less like a vote of confidance and more like process of elimination.

I suppose that all of this growth in investment has simply not yielded growth in the economies of these countries (based on the lack of growth discussed on January 3 and January 4)?