Markets with the Fed under assault

Don't let yesterday's quiescent markets fool you - Dollar debasement is coming

The Trump administration’s assault on the Fed is unprecedented and serious. The big puzzle is why markets yesterday showed such a tepid reaction and whether this means they don’t care. Today’s post disentangles several things that are going on. My bottom line is that markets care a great deal. If the Trump administration’s assault on the Fed continues, which is my base case, the Dollar will enter a protracted decline.

There’s many moving parts to the last 48 hours and it’s important to be clear about each of them. First, as yesterday wore on, reports emerged that the investigation of the Fed was launched without a heads-up to the Treasury or top officials in the White House, giving the impression the administration was distancing itself from things. In addition, several Republican lawmakers came out in rare opposition, even threatening to hold up Trump nominees to the Fed. If you’re glass-half-full, you might be tempted to think US checks and balances work and the administration will step back. If you’re glass-half-empty, this administration’s pursuit of lower interest rates into the midterm elections later this year stops at nothing and the Fed probe is just the latest symptom of this. Yesterday’s mixed signals gave something to both camps, which is the most obvious reason why market reaction was muted.

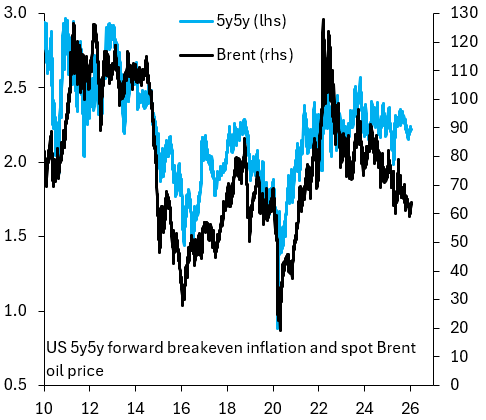

Second, markets aren’t nearly as forward-looking as people think. Perhaps the thing that vexes people most is that breakeven inflation - what markets price for inflation in the future - was pretty much unchanged yesterday. However, as I discussed in a recent post, things like 5y5y forward breakeven inflation are hopelessly lost in the here and now, which is why they move so closely with spot oil prices as the chart above shows. The truth is that markets won’t price a meaningful pick-up in inflation until it’s staring them in the face.

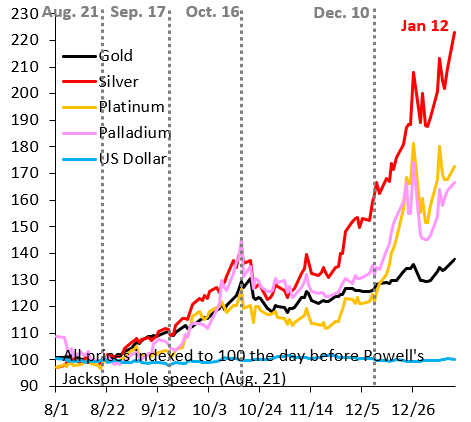

Third, while traditional markets like breakeven inflation were overthinking things, the debasement trade roared ahead. The chart above shows gold (black) and silver (red) yesterday reached new all-time highs. This is important because fear of debt monetization is the main driver behind the rally in precious metals. Markets most attuned to infringement of Fed independence are highly sensitive to what’s going on.

Traditional markets will hum and haw until a new Fed Chair is in the saddle, at which point - in my opinion - we’ll get a much more aggressive easing cycle than is currently priced. That’ll be the catalyst for Dollar debasement to begin in earnest.

Brilliant take on the oil-breakeven correlation paradox. I've watched trader after trader treat those 5y5y forwards like gospel for longterm expectations, but they're basically just oil proxies at this point. Had a colleague last year argue with me for weeks that inflation expectations were anchored when really we were jsut watching Brent move around. The gold/silver divergence is way more telling aboutwhat smart money thinks of institutional credibility right now.

I struggle to understand how it is that a weaker dollar is completely bad. I don’t mean there are not bad aspects, but there are good ones too. Also, to what lengths will China go to prevent the yuan from appreciating?