The Fed and the Dollar

The Dollar fell sharply yesterday as markets positioned for a 50 basis point cut

The Dollar weakened sharply yesterday and for the first time fell below its previous low from early July. That drop likely reflects markets positioning for a bigger-than-expected 50 basis point cut at today’s FOMC meeting. Such a cut would certainly be a surprise and would see the Dollar weaken further, but I think it’s unlikely. In today’s note, I go through the options available to the Fed. My best guess is that we get a 25 basis point cut followed by a dovish press conference that opens the door to two further cuts this year (for a total of 75 basis points in cuts). That preserves optionality and avoids a hawkish pullback in markets, which price 70 basis points through the end of the year.

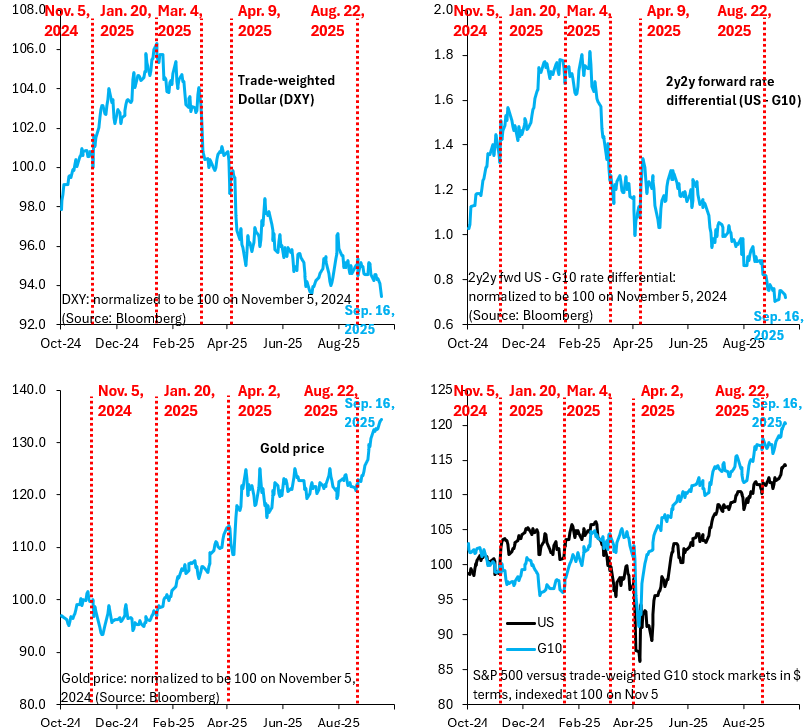

The Dollar weakened sharply yesterday, falling below its previous low of July 2 (top left chart). Yesterday’s fall likely reflects markets positioning for a bigger-than-expected 50 basis point cut, but - as the top right chart shows - this fall was really a catch-up to the 2y2y forward rate differential of the US versus the rest of the G10, which fell sharply after Chair Powell’s very dovish Jackson Hole speech on August 22. That speech sparked a remarkable rally in gold (bottom left chart) and - with a lag - has also powered the S&P 500 higher (bottom right chart, black line), even as signs mount that the labor market is slowing significantly.

As I see it, the Fed has three options today: (i) a 50 basis point cut; (ii) a dovish 25 basis point cut that opens the door to two additional cuts this year; (iii) a hawkish 25 basis point cut that signals only one further cut this year. The appeal of a 50 basis point cut is that it gets ahead of what looks to be material deterioration in the labor market and political pressure from the White House. The disadvantage is that it may encourage the perception that the Fed is increasingly political. A hawkish 25 basis point cut avoids that risk, but could cause a serious backlash in markets, which could intensify political pressure from the White House. So the best option - in my mind - is to do a 25 basis point cut, coupled with dovish messaging in the press conference. That avoids a risk-off in markets and preserves optionality down the road.

My readers will be disappointed to find that I’m not discussing the economy at all. There’s two reasons. First, given all the build-up to today, this meeting is primarily political, like it or not. Second, the economy looks to be evolving almost exactly in line with the Fed’s forecasts published in June. The economy is therefore a sideshow.

La economía es, por lo tanto, un espectáculo secundario.

Vaya epílogo¡