What we know about rising gold prices

Rising gold prices and soaring long-term yields have the same driver: too much debt

The IMF/WB annual meetings are happening in DC this week. It’s not unusual for discussion at these meetings to gravitate towards one particular theme, especially if something big is going on in markets. At these meetings two years ago in Marrakech, practically every meeting started with the same question: “Do you know why the 10-year Treasury yield is going up so much?” At the time, the 10-year Treasury yield was pushing towards 5 percent - its highest level since 2007 - in a move that seemed to come out of nowhere and that no one really understood.

At this week’s meetings, the first question people have is: “Do you know why gold prices are going up so much?” The parallels with Marrakech are striking. The latest rise in gold prices seems to have also come out of nowhere and no one really has any idea what’s going on. In today’s post, I’ll lay out what I think we know (and don’t know).

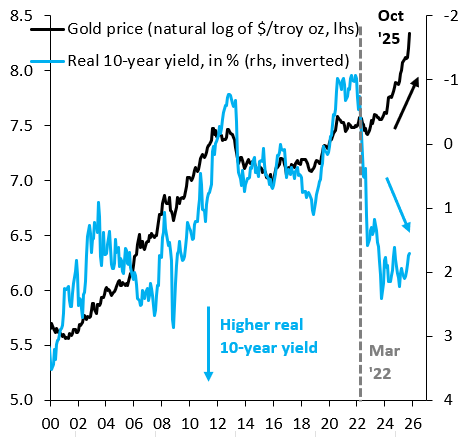

Something changed in 2022 after Russia invaded Ukraine: historically, as the chart below shows, gold prices (black line) have tended to rise when the real 10-year Treasury yield (blue line) has fallen, such as during and after the 2008 crisis. However, this link broke down after Russia invaded Ukraine in 2022, inviting lots of speculation that central banks around the world - wary of having their foreign exchange reserves sanctioned - began diversifying into gold. Too much gets made of this point. After all, gold prices didn’t really take off until early in 2024. But it’s also true that gold prices didn’t fall in their usual manner as real rates rose in 2022 and 2023. Maybe there really was a “new” buyer in the form of central banks in emerging markets. If so, anecdotal evidence suggest that this shift ended quite some time ago and isn’t driving the latest rise in gold prices.

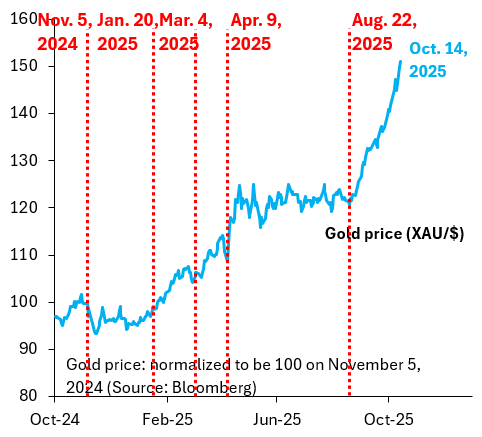

Tariff chaos and debasement fears drive gold prices in 2025: as the chart below shows, there’s been two distinct “step” changes in gold prices this year. The first was in early April, when the chaotic roll-out of reciprocal tariffs spooked markets, powering gold prices up. The second came after Chair Powell’s dovish Jackson Hole speech, which set a clear signal that the Fed would resume its rate cutting cycle. In both cases, there’s a straightforward macro interpretation to rising gold prices. In the first, markets were looking for a safe haven from the global trade war and chaotic policy. In the second, the resumption of Fed cuts unleashed another round of safe haven buying.

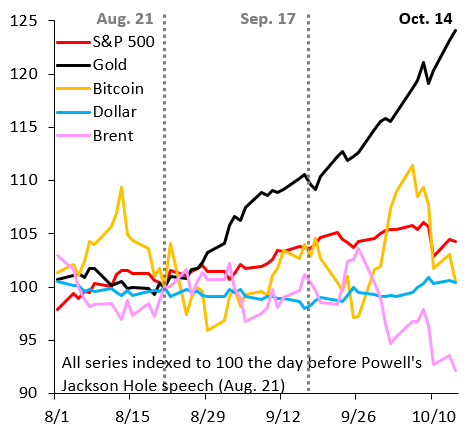

The rise in gold prices since Jackson Hole is very unusual: as the chart below shows, gold prices (black line) are up in an almost straight line since August 22. That’s remarkable given that the Sep. 17 Fed meeting was more hawkish than expected - something that should have caused a material pull-back in gold - and given all the back and forth over rare earths with China. Furthermore, the latest rise in gold prices has coincided with a stable Dollar (blue line). Whatever is going on now, it’s not about a flight out of the Dollar as in April. The current rally must therefore be about a broader flight out of all G10 currencies, which makes me sympathetic to what people are calling “the global debasement trade.”

So here’s what we know. This year’s gold rally has come in fits and starts. The April move was about a loss of confidence in the Dollar, a move that’s since run out of steam. The move since Jackson Hole is about “global debasement” and coincides with three notable developments: (i) there’s a global rise in long-term government bond yields as markets increasingly worry about unsustainable fiscal policy in many places; (ii) the universe of safe haven countries has shrunk because Germany and Japan are at the forefront of the global rise in yields; and (iii) the few safe haven countries that remain - notably Switzerland - are small, with limited capacity to absorb safe haven inflows. These three forces are supercharging the rise in gold prices, which is really about the global deterioration in fiscal sustainability and growing risk that debt overhangs will be inflated away.

What we don’t know is who is driving the latest rise in gold prices. There’s endless rumors about another round of central bank buying, but I am skeptical. There’s a clear macro catalyst to the latest move in the form of Jackson Hole. I find it hard to believe that central banks in emerging markets will be trading such a catalyst. It’s more likely that this is a genuine market move, with a growing number of investors worried about fiscal sustainability and debasement. If that’s true, the gold move can go a lot further.

whats clearly driving gold is the same bunch of mommentum traders private and institutional that are driving tech stocks, crypto, mem stocks, options and pretty much everything else in the big casino!

The gold price today feels more like a narrative than a commodity. Paper gold dominates trading, so what we’re really seeing is market psychology at work — a reflection of collective belief in (or fear of) monetary credibility rather than shifts in physical demand.