Why Fed independence is so important

Monetary policy credibility can be easily lost, but is very hard and costly to regain

In March 2021, Turkey’s President Erdogan fired Naci Ağbal, the hawkish Governor of the central bank, and replaced him with someone who cut policy rates aggressively. Turkish Lira went into a depreciation spiral from which it has yet to recover, inflation has soared and the central bank’s policy rates are far higher now than they ever were under Naci Ağbal. As I argued in a recent post, this episode shows why central bank independence is so important and why - once this independence is lost - it is very difficult and costly to regain monetary policy credibility.

Of course, the US is very different from Turkey. Institutional integrity is stronger and decades of good policy mean there’s lots of credibility that won’t erode overnight. Yet the Fed is clearly under pressure from the White House to cut rates and the ongoing debate over reserve currency status of the Dollar signals markets are questioning how credible the US policy framework is these days.

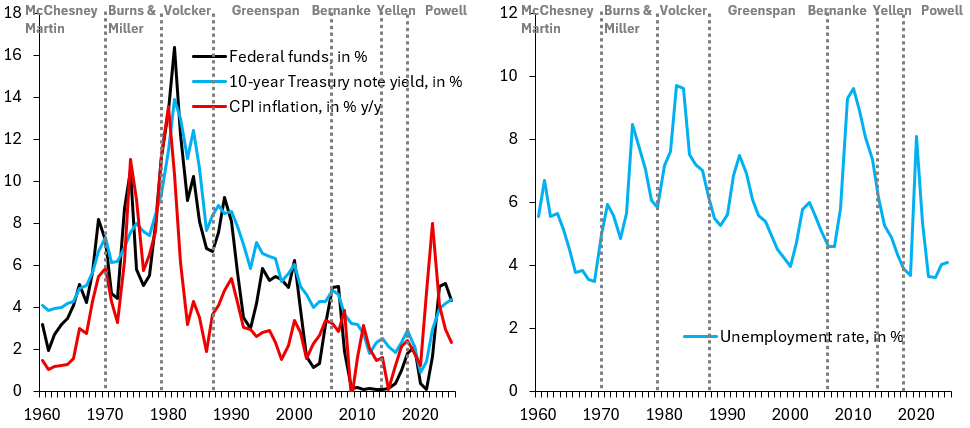

Indeed, it’s not that long ago that the Fed was struggling to regain monetary policy credibility after a series of oil shocks pushed up inflation in the 1970s. To bring inflation back under control and restore the Fed’s credibility, then Chair Paul Volcker allowed real interest rates - the difference between nominal rates and inflation - to rise to punitive levels (left chart above), pushing the unemployment rate up to its all-time high in the post-war period (right chart above). This very costly disinflation episode set the stage for the subsequent two decades of low and stable inflation, which ended with the COVID pandemic.

The US is therefore no stranger to how costly it is to regain central bank credibility. As I’ve noted in many previous posts, it’s mostly cyclical factors that are driving the fall in the Dollar now, but the fact that reserve currency status is even being debated is worrying. This is the worst possible time to be undermining Fed independence.

In this MAGA universe we live in now it is totally lost that he is a Republican originally nominated by Trump.

To stay focused on the mission rather than be a doormat for Trump takes real integrity and courage. America will need a lot more people like him if we want to get through these next few years.

While the debate over whether the Fed should cut rates rages on, financial conditions—as measured by the Fed itself—are anything but restrictive.

In fact, by the Fed own’s measure, they’re veering expansive. Yet another bizarre disconnect that defines this macro regime.

https://x.com/PietroVentani/status/1941055766913495178