Why the Dollar has fallen so much

Markets price aggressive rate cuts from the Fed, which may reflect political pressure

The Dollar has fallen 10 percent so far this year. Much of this happened in discrete drops around key tariff announcements, like in early February when Canada, China and Mexico were hit and again around Liberation Day in early April when reciprocal tariffs were first unveiled. Since that time, the Dollar has been essentially stable, even as US data have failed to validate market expectations of recession.

In today’s note, I look at what’s been driving the Dollar fall. As I’ve noted previously, the fall in the Dollar is almost perfectly explained by interest rate differentials, which have moved sharply against the Dollar because markets think the Fed is more dovish than other central banks.

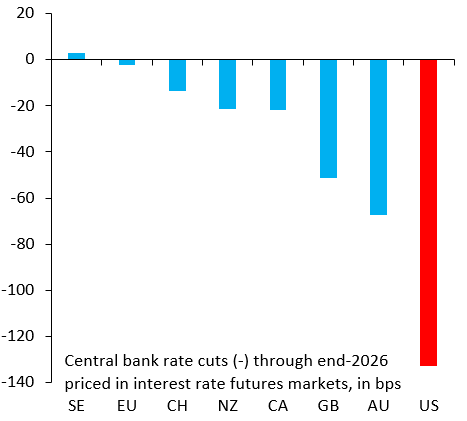

The chart above shows what’s going on. It uses interest rate futures to calculate how much markets expect key central banks to cut their policy rates through the end of next year. As of Friday, markets priced 130 basis points in cuts for the Fed (so slightly more than five 25 basis point cuts) in contrast to an ECB that’s expected to be on hold. Only the Bank of England (GB) and Reserve Bank of Australia (AU) come close in the eyes of the market, with 50 and 70 basis points priced, respectively.

Why are market pricing so many more cuts for the Fed? I can think of three possible reasons. The first is that they think tariffs will boomerang on the US, forcing the Fed to cut aggressively as recession risk mounts and holds down any inflation impulse from tariffs. The second is that the Fed last cut in December of last year while other central banks kept cutting. For example, the ECB has already made four 25 basis points cuts this year, bringing this easing cycle to 200 basis points, double that of the Fed. The third is that markets price aggressive Fed easing not because of economic fundamentals but because of mounting political pressure. In effect, the Fed may be seen as the central bank most under siege in the G10.

It’s impossible to disentangle how important each of these drivers is. I’m not a fan of the first one because tariffs are inflationary for the US and deflationary for everyone else. I have some sympathy for the second explanation, which basically says that the Fed has some catching up to do. The third is the most important and speaks to the credibility of the Fed. It’s possible that all the rate cuts priced for the Fed reflect a market view that it won’t be able to stand up to pressure from the White House.

“The first is that they think tariffs will boomerang on the US, forcing the Fed to cut aggressively as recession risk mounts and holds down any inflation impulse from tariffs.“

I think this is right, but with the causation reversed. The relative prices changes from tariffs threaten recession unless the Fed facilitates adjustment by additional over-target inflation.

I would not interpret the dollar’s fall as indicating expectations of recession, but that poor governance — tariffs being a good indictor — just made the US a less desirable place to invest.