Everything you need to know about gold

Gold prices are going through the roof and this isn't due to foreign central banks

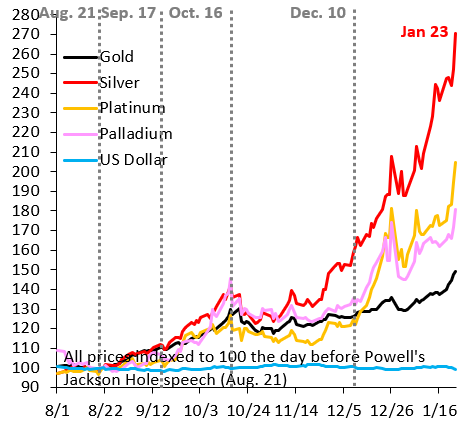

The rise in precious metals prices is breathtaking and profoundly scary. Gold is now up 50 percent since August 22, which is when Chair Powell gave his dovish keynote speech at the Jackson Hole symposium, the event that started the “debasement trade.” There’s a lot of chatter about what’s driving the rise in gold prices, so this post runs through four points that I think summarize what we’re seeing.

The rise in gold is part of something much bigger: as the chart below shows, all precious metals prices are going through the roof and gold is a laggard compared to silver and platinum. At the same time, we’re seeing government bond markets in high-debt countries like Japan under severe pressure, even as there’s a flight to safety into countries with low debt like Sweden, Norway and Switzerland. Gold is therefore a symptom of something much bigger. We’re at the start of a global debt crisis, with markets increasingly fearful governments will attempt to inflate away out-of-control debt. Gold is just one of many assets that are getting a “safe haven” bid as part of this phenomenon.

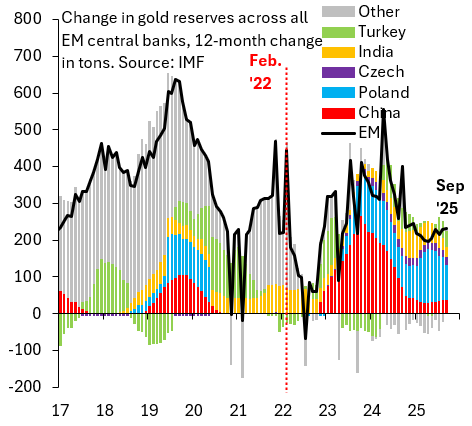

Central bank gold buying is NOT driving the rise in gold prices: there’s a lot of chatter that US sanctions weaponized the Dollar, causing foreign central banks to shift official reserves out of the Dollar and into gold, especially after the wave of sanctions on Russia after the invasion of Ukraine. There’s no evidence to support this. The chart below shows IMF data on gold buying for all emerging markets. Four points are worth noting. First, there is no acceleration of gold buying after Feb. ‘22, which is when Russia invaded Ukraine and the sanctions onslaught began. Second, central banks are certainly buying gold, but they’re doing so at a slow and steady pace. They’re not in a buying frenzy that explains the massive rise in gold prices underway. Third, it’s possible that countries are hiding their gold purchases. China is almost surely doing that. After all, it conceals its intervention in foreign exchange markets via state banks, so what’s to prevent it from hiding gold purchases? But - again - this is unlikely to be happening with the kind of frenzy that can explain the current run-up. Fourth, even if foreign central banks are buying gold, they’re not also buying silver, platinum or palladium. The fact that this is a broad bubble across all precious metals argues against central banks being a key driver. Occam’s razor is that we’re seeing a speculative bubble, which - as in all past bubbles - is driven by retail investors, not some official actor.

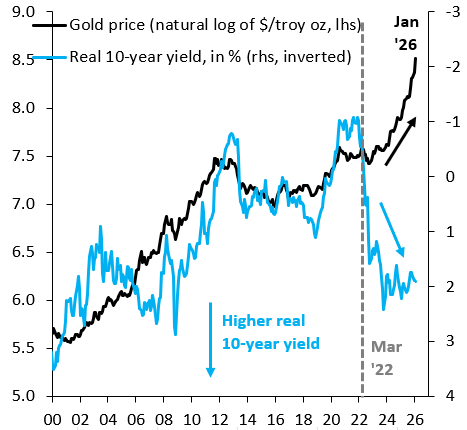

The debasement trade is a “structural break:” the black line in the chart below shows the natural log of the XAU/$ gold price in Bloomberg, while the blue line shows the real 10-year Treasury yield, which I have inverted and am showing on the right axis. Historically, gold prices fall when real rates rise. That makes sense because gold doesn’t pay interest, so the opportunity cost of holding it goes up when interest rates rise. The problem is that this relationship has broken down in spectacular fashion. The “fear factor” from unsustainable fiscal policy in so many countries is large. Countries with lots of public debt ignore this at their peril.

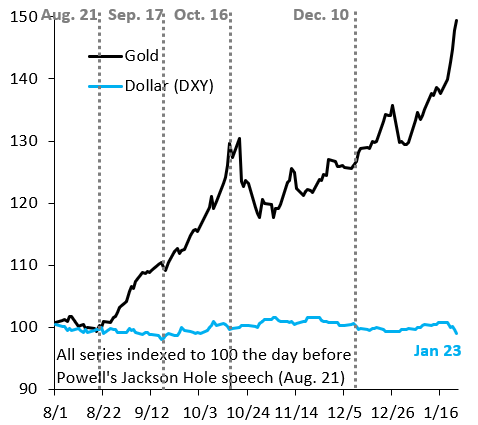

Dollar debasement will accelerate the rise in gold: the Dollar was stable in the second half of 2025, even as gold prices and the debasement trade got going. That is changing. As the chart below shows, the Dollar had a very bad start to 2026, in line with my call that Dollar weakness will resume after the hiatus of H2 2025. A falling Dollar will super-charge the rise in gold prices and the debasement trade because it boosts the purchasing power of non-Dollar buyers. The trajectory is thus for the debasement trade to accelerate as Dollar weakness resumes.

“Occam’s razor is that we’re seeing a speculative bubble, which - as in all past bubbles - is driven by retail investors, not some official actor.”

I found this conclusion of yours to be incongruous, if by “speculative bubble” you imply an element of the irrational or at least the unjustifiable. Your entire post seems to have argued the opposite. Falling real rates (though at close to 2%, 10y TIPS are still giving one a positive — and apparently — inflation-indexed return) and fear of dollar debasement from inflating away non-indexed public debt will have powered the demand for precious metals. Nothing irrational and unjustifiable about that.

The further and more troubling question is whether debasement also implies selective default and repudiation of the government’s liabilities. Let’s not forget that that weird duo and comrades-in-arms, Bessent and Miran, have both separately hinted at an Latin American solution, circa 1980s, where foreign creditors could have their Treasury holdings redenominated into 100-year bonds at a low fixed rate. The fall of the dollar against even currencies of economies with their own public debt overhang problems would strongly suggest that. Bullion, especially gold, would seem to make eminent sense to many more investors than just the US retail sector.

For the pleasure of having your opinion, I take the liberty of sharing with you the link to a post I have recently written about the price of gold. The conclusions are very similar, perhaps only the angle of observation is slightly different, more politics oriented.

https://open.substack.com/pub/marketszoon/p/the-value-of-uncertainty?r=58uzcq&utm_medium=ios