How US tariffs are hurting China

Goods that would have gone to the US now get discounted and sold somewhere else

In recent days, I’ve published several pieces arguing that China’s use of rare earths to escalate the trade war with the US is a sign of weakness, not strength. This has caused a huge amount of pushback, with the dominant narrative being that the resilience of China’s exports in the face of tariffs gives it the upper hand over the US. This post explains why China’s export sector must be hurting badly. China chose to escalate because it has not other choice. Its export sector is running on borrowed time.

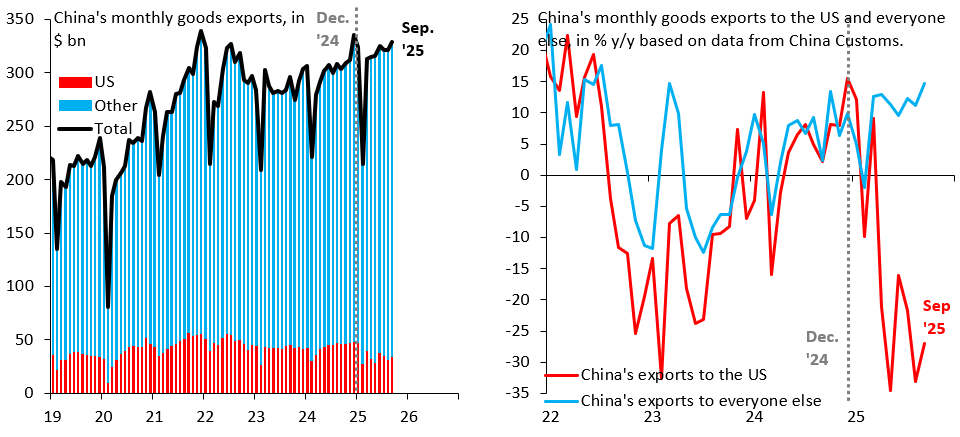

The two charts above illustrate the key stylized facts about China’s exports in the face of US tariffs. Overall exports have remained stable (left chart), but that’s because a sharp drop in exports to the US (right chart, red line) has been offset by a rise in exports to everywhere else (right chart, blue line).

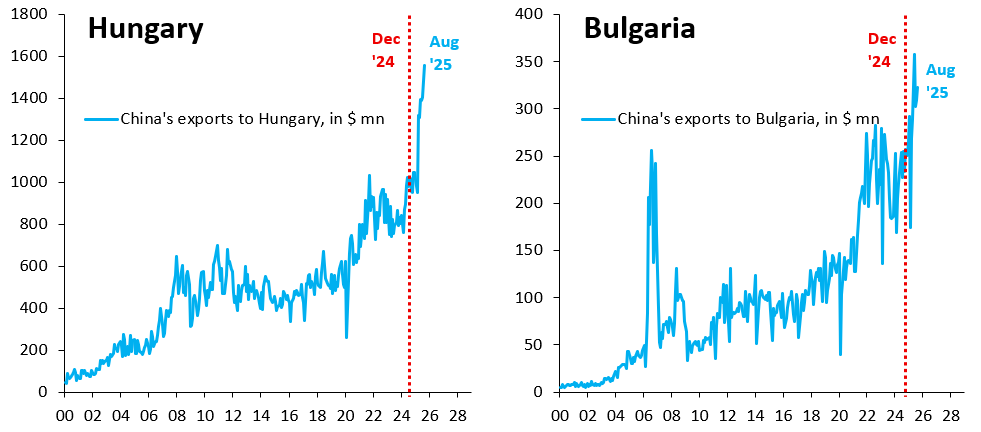

There’s two possible explanations for the rise in exports to non-US countries: (i) trade diversion, whereby China exports goods that otherwise would have gone to the US to new markets; and (ii) transshipment, whereby goods are shipped to the US via third countries. Both things are likely happening, but the former probably dominates to a substantial degree. Examples abound of Chinese exports to all kinds of places ballooning this year. The two charts below show exports to Hungary (left chart) and Bulgaria (right chart), to pick two of many examples.

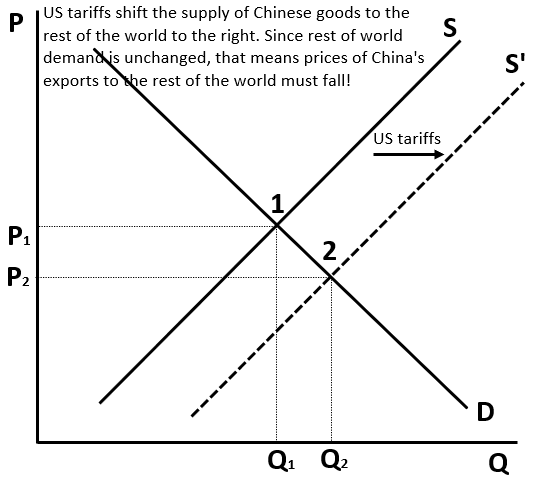

The simple chart below shows why trade diversion - even though it keeps Chinese goods flowing - is still a negative hit to exporters. If China is redirecting goods to the rest of the world, this equates to a shift down and to the right of the supply curve. The rest of the world didn’t ask for this rise in supply of Chinese goods, so China has to cut the price of its exports to generate demand. This is a move down the demand curve, which means falling prices, which is how China is shipping lots more goods to countries other than the US.

The bottom line is that US tariffs are an adverse hit to the profitability of China’s exporters, who have to accept lower prices to offload goods that otherwise would have gone to the US. If instead goods are being transshipped to the US in substantial numbers, that means higher transportation costs, which also adversely hits margins of Chinese exporters. All this means that China’s choice to escalate the tariff stand-off with the US in recent days likely stems from economic weakness, not strength. China desperately wants the US to lift its tariffs and relieve the pain on its exporters.

If Chinese exports are flooding other parts of the world at a lower prices then it will be a powerful deflationary push for those areas of the globe. Europe is one of the big recipients of the Chinese export flow; how long until this gets reflected in European CPI numbers?

I believe your bottom-most chart of supply and demand curves contains a graphical error. Your chart shows a new supply curve as a result of U.S. tariffs on imports from China and a new lower price equilibrium. However, this is conceptually incorrect. To wit, if Chinese exports have remained stable, that suggests the supply curve has remained the same. Tariffs imposed by the U.S. have caused the demand curve to shift leftward along the existing supply curve (and, consequently, a lower price equilibrium and lower quantity demanded).

In other words, supply has remained the same but demand has decreased. As to your larger point, trade wars hurt all trading partners. If Chinese exporters must accept lower prices for the same quantity of goods, their net revenues will decline. But American soybean farmers have seen their exports collapse. There have been no equivalent stories of Chinese exporters collapsing. So while it is true that Chinese exporters will suffer some damage from the trade war, this is a 'cost' of the trade war that China is willing to pay. Is the U.S. willing to pay the 'cost' of seeing its soybean export market completely evaporate?