Why are long-term yields rising?

Deficits are wide, debt is high, and yields have been kept artificially low for many years

A few months ago, right when I was starting to write these daily posts, I did a series of pieces on upward pressure in long-term government bond yields. Those posts laid out two factors that are putting upward pressure on yields. First, budget deficits are wide across almost every advanced economy, so there’s lots of new debt supply that markets constantly have to absorb. They’re demanding higher yields to do that. Second, central banks have kept long-term yields artificially low via QE. What we’re now seeing is a catch-up in long-term yields as the cumulative effect of QE starts to fade.

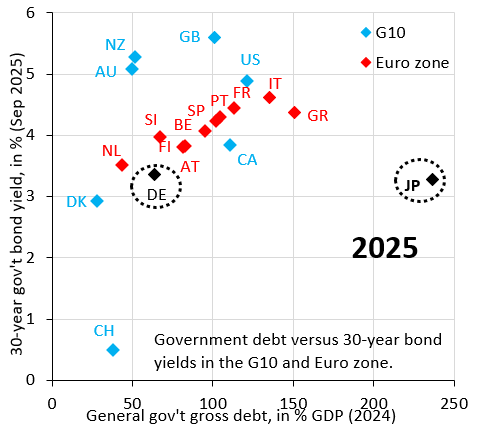

The chart above illustrates just how important the second factor is. The chart shows 30-year government bond yields on the vertical axis and gross government debt in percent of GDP on the horizontal axis. I’ve highlighted the Euro zone countries in red, the rest of the G10 in blue, and Japan and Germany in black. Japan and Germany have special significance in this chart because they both have 30-year government bond yields around 3.3 percent, but debt levels are wildly different. Japan had gross government debt of 240 percent of GDP last year, while Germany stood just above 60 percent. The fact that Japan doesn’t have a higher yield is entirely due to huge QE purchases by its central bank. As the Bank of Japan increasingly steps back from capping longer-term yields, Japan’s 30-year yield is likely to rise a lot further.

When markets start to care about the level of debt is difficult to pin down. Sometimes they care, sometimes they don’t. That means there’s multiple equilibria, with lots of different possible outcomes. What’s clear - regardless - is that we’re now in an equilibrium where markets really care about debt and where there’s still lots of room for yields to rise from artificially low levels.

Thank you for your post Robin, I agree 100%.

Can you please explain the euro zone debt/gdp ratio in the chart ? I am not able to understand, as the debt gdp ratios of the single nations are lower than that ..

It’s media hysteria and is adjustable rates are neutralizing it.