Why is Italy's spread disappearing?

The spread is shrinking because of Ukraine, not because of Italian fundamentals

One of the themes I’ve been writing about is the global rise in long-term yields. Aggressive fiscal stimulus during COVID pushed up debt levels everywhere and - to make matters worse - budget deficits are out of control in many places, most notably in the US. Markets are punishing this profligacy by pushing up global yield levels.

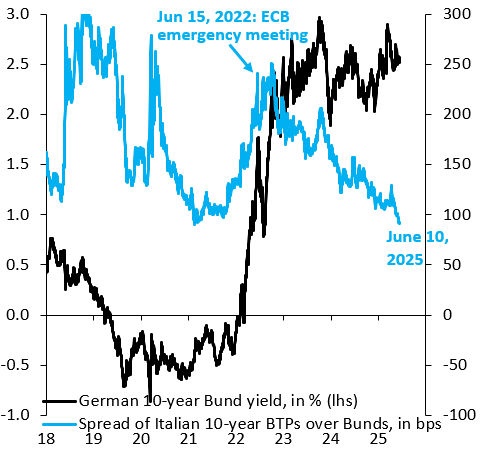

There’s one notable exception, which is Italy. Italy’s long-term yield has fallen and its spread over German Bunds is the lowest in a long time. This is a puzzle. Italy’s debt stands at 140 percent of GDP, which is twice as high as Germany. With German (and global) yields rising, Italy’s spread should widen to compensate investors for the increased risk of managing such an elevated debt level in a high yield environment.

How to explain this puzzle? Past bond market interventions to cap Italy’s yield have created in markets an expectation of an ECB “put,” but this doesn’t explain why Italy’s spread keeps narrowing relentlessly. The Financial Times yesterday published an article claiming the narrowing spread reflects a favorable fiscal and growth picture, but - let’s get real for a second - Italy’s budget deficit in the first five months of 2025 is wider than in the same period in 2020, which was the peak of the pandemic.

A more likely explanation for the relentless narrowing in Italy’s spread (blue line) - even as Germany’s 10-year yield is at elevated levels (black line) - is war in Ukraine. Markets are betting that Germany and other fiscally frugal countries won’t force Italy to make any kind of meaningful fiscal adjustment, as war in Ukraine makes any kind of confrontation within the EU especially risky. In effect, markets are trading the war as a catalyst for yet more debt mutualization, via joint EU debt issuance or ECB bond buying. Indeed, as prospects of any kind of pause in the war have faded recently, Italy’s spread has taken another leg lower, a sign this is what’s going on.

Markets are betting that Germany won’t dare confront Italy over its high debt burden and they’re right. Germany hasn’t dared confront Italy during more tranquil times. It certainly won’t dare confront Italy now.

Thank you for sharing this observation. I will try to find other times when this happened.

Interesting mechanism. Assuming it holds, there is a trend for all European debt to be put in the same bucket due to political considerations. Which would in turn rise yields in fiscally sound countries while dampening the hit in the ones worst off. Sure, it will reduce spreads but the incentive structure all but guarantees more questionable outcomes.