Dollar Collapse

The Dollar has broken below the range it held in all of H2 2025 - an ominous sign

The Dollar has been cratering the last few days, in line with my call that we’d see a resumption of Dollar weakness with the start of 2026. What’s especially ominous is how quickly we’ve fallen below the range in which the Dollar traded for the second half of last year. That’s usually a sign that momentum is building, which means this round of Dollar weakness is far from done.

When people on trading floors talk about the Dollar, they’re usually talking about Bloomberg’s DXY index, which measures the strength of the Dollar against six G10 currencies. This index has a weighting of almost 60 percent on the Euro, so it really just measures how the Dollar is doing versus the Euro and not the broader picture.

Today’s post uses weights from the Federal Reserve to construct a broad Dollar index across 26 countries, of which seven are in the G10 and the remaining nineteen are in emerging markets (EM). This gives a much more comprehensive look at what’s going on and also allows me to make different “cuts” of the data. One particular issue is that the Yen has been strengthening like crazy these past few days because of intervention fears. This rebound, which is likely temporary since Japan’s interventions never have a lasting effect, means Dollar weakness may be overstated. I adjust for this by dropping the Yen from one particular “cut” of data. Yet, no matter how I “cut” things, the Dollar is tumbling at an alarming pace.

As I noted yesterday, this is the second time within a year that we’re seeing this kind of rapid fall (the first was in April 2025 after the chaotic rollout of reciprocal tariffs). Foreign investors are once again rushing to hedge their Dollar holdings, which means we’re seeing another crisis of confidence. This will damage US reserve currency status if it keeps happening.

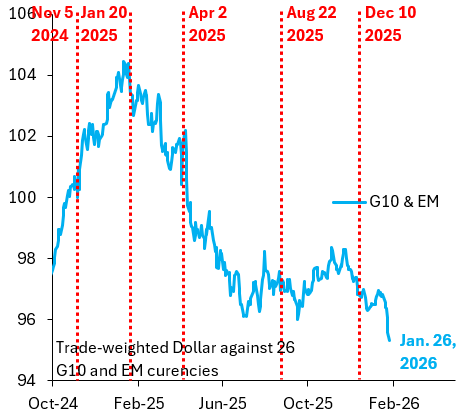

The blue line in the chart above shows the trade-weighted Dollar against the 26 countries for which I have Fed weights. The vertical red lines denote key turning points since late 2024: (i) the election on Nov. 5, 2024; (ii) the inauguration on Jan. 20, 2025; (iii) rollout of reciprocal tariffs on Apr. 2, 2025; (iv) Chair Powell’s dovish keynote at Jackson Hole on Aug. 22, 2025; and (v) the most recent Fed rate cut on Dec. 10, 2025, which sparked a resumption of the crazy rally in precious metals.

There’s two takeaways from this chart. First, the drop we’re seeing in recent days is as severe as after the rollout of reciprocal tariffs in April 2025. Indeed, what’s happening now is a very similar crisis of confidence. Second, we’ve very clearly fallen below the range the Dollar moved in during the second half of last year. That’s an ominous signal for the Dollar.

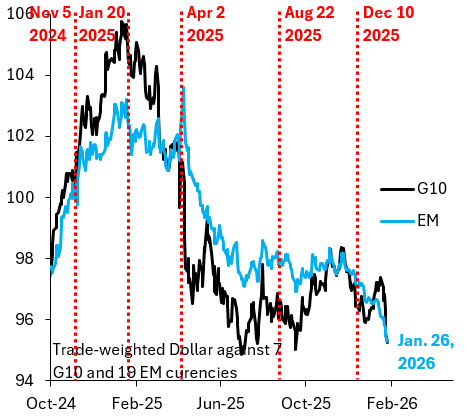

The chart above separates out the Dollar versus the G10 (black line) and the Dollar versus EM (blue line). The latter has very clearly fallen below the range it cycled in during the second half of last year and I’ve flagged this index as a leading indicator for Dollar direction. The Dollar versus the G10 hasn’t quite fallen below its low from July of last year, but - as I flag above - there’s a wrinkle here relating to the Yen.

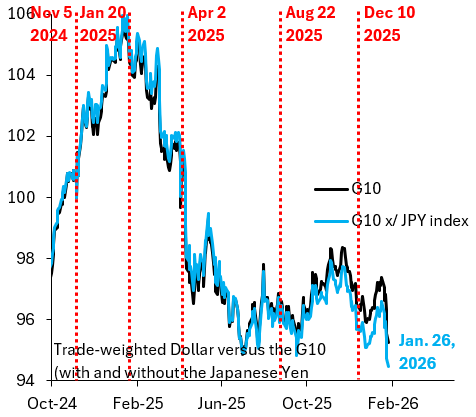

The black line in the chart above is the same G10 Dollar index as in the previous chart. The blue line modifies this index by dropping Japan. This mutes the Dollar drop of recent days, but this effect is outweighed by sustained Yen weakness in the months leading up to last week, when Yen weakness made the Dollar look stronger than it really was. The net effect of these two things is that the G10 Dollar has fallen below the range it traded in during the second half of last year. Across the board, the picture is therefore quite alarming. No matter how you “cut” the data, the Dollar is tumbling.

Why do you say the dollar drop is alarming? Do you take it as a symptom of alarms about US debt, or that markets are forecasting a drop in U.S. growth?

Go beyond saying that it's quite alarming to discussing why this happening and what the implications are if it keeps happening.